Global Digital Health VC funding breaks record in Q1 2020 with $3.6 B

April 21, 2020 | Tuesday | News

Digital Health companies secured over $60 billion since 2010

Mercom Capital Group, llc, a global communications and research firm, released its report on funding and merger and acquisition (M&A) activity for the Digital Health (Healthcare Information Technology) sector for the first quarter of 2020. Mercom's comprehensive report covers deals of all sizes from across the globe.

Global venture capital (VC) funding, including private equity and corporate VC into Digital Health companies in Q1 2020, came to a record $3.6 billion in 142 deals compared to $1.7 billion in 142 deals in Q4 2019. VC funding in Q1 2020 increased by 79% compared to the same quarter of last year (Q1 2019) when $2 billion was raised in 149 deals. This was the single largest funding quarter ever for Digital Health.

Several large VC deals spurred record funding. Of the $3.6 billion raised during the quarter, the top 10 deals (ClassPass, Alto Pharmacy, KRY, Concerto HealthAI, Element Science, Zhiyun Health, Tempus, Verana Health, Virta Health, and Hinge Health) accounted for about 42% of the total, bringing in $1.5 billion from some well-known investors, including GV (formerly Google Ventures), New Enterprise Associates (NEA), SoftBank Vision Fund 2, Bain Capital Ventures, and Bessemer Venture Partners.

Digital Health companies have brought in over $47 billion in VC funding in 4,905 deals since 2010.

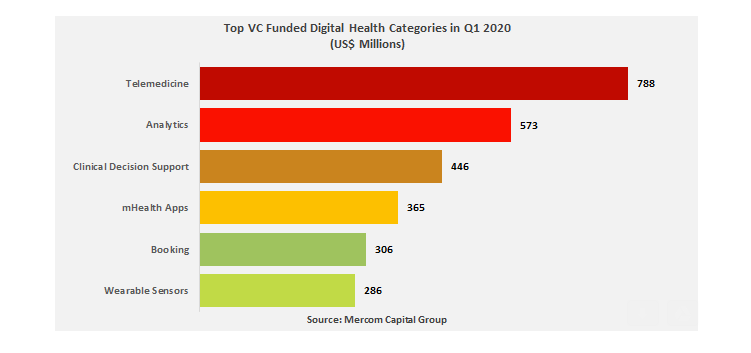

The top-funded categories in Q1 2020 were: Telemedicine with $788 million, followed by Data Analytics with $573 million, Clinical Decision Support with $446 million, mHealth Apps with $365 million, Healthcare Booking with $306 million, and Wearable Sensors with $286 million.

“There was no evidence of coronavirus affecting digital health funding in Q1. Going forward, we anticipate investors to become more selective in this environment. The era of “I don’t want to miss out” investments may be over. That may not be a bad thing,” said Raj Prabhu, CEO of Mercom Capital Group.