India & Vaccines: Where Are We?

August 01, 2023 | Tuesday | Views | By Vandana Iyer, Industry Principal- Health & Wellness, TechVision, Frost & Sullivan

COVID-19 pandemic accelerated the development, manufacture, and distribution of vaccines at an unprecedented speed and scale

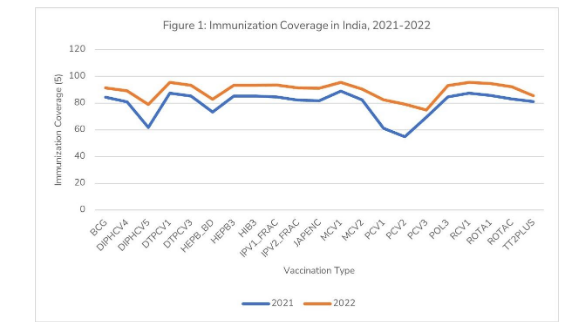

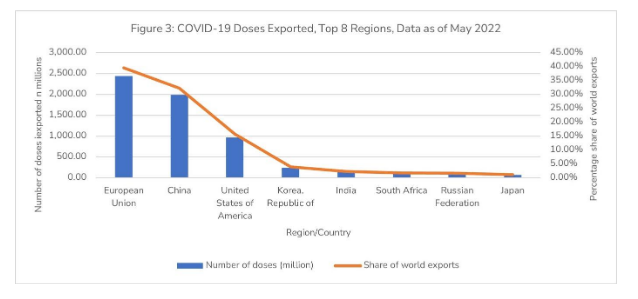

Despite being one of the leading manufacturing hubs, India’s vaccination coverage is still below the world average. In 2021, global immunisation coverage was 81 per cent and India’s coverage was only 79.6 per cent. However, the number changed drastically to 89.4 per cent in 2022. As seen in Figure 1, the increase in immunisation coverage in India can largely be attributed to an increase in diphtheria and pneumococcal vaccinations.

Data analysis from the above figure also reveals that there is a consistent dip between the nth and the (n+1)th doses of vaccines. For instance, in 2021, the DTP-containing vaccine, 1st dose had a coverage of approx. 87.5 per cent in India, which decreased to about 85.2 per cent in the second dose of the vaccine, and a similar trend followed in the subsequent year for the same vaccination doses. There must be an increased focus from the public sector on ensuring the completion of vaccination doses to achieve optimal vaccine efficacy.

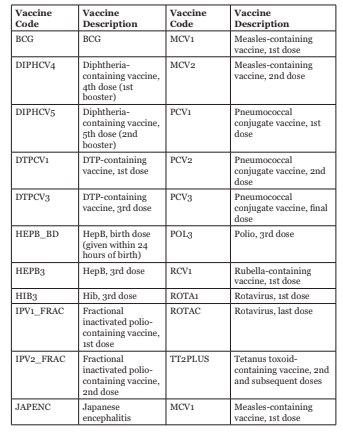

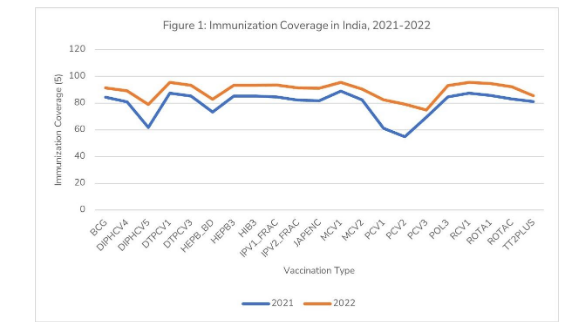

Another cause for concern in the Indian immunisation landscape is the increase in reported cases of typhoid and measles in 2022 (Figure 2). The reported cases for typhoid increased from 0 in 2021 to 4,02,532 in 2022 and for measles, it increased from 5700 in 2021 to 40967 in 2022. The huge increase in typhoid cases was most likely due to the increased drug resistance and low immunisation coverage and not a consequence of poor hygiene or water contamination. However, the high cost of the vaccine continues to be a major roadblock to nationwide adoption.

Thus, the National Technical Advisory Group on Immunisation, or NTAGI, advised the Government of India to include the typhoid conjugate vaccine as a part of its routine immunisation programme as that would lead to improved affordability of the vaccine. The Indian immunisation schedule should incorporate changes that arise due to endemics and/or pandemics and must rapidly implement the reforms to ensure optimal health coverage. This is crucial for timely action and management of infectious diseases and will help bolster Indian stand in the global immunisation landscape.

COVID-19 vaccines

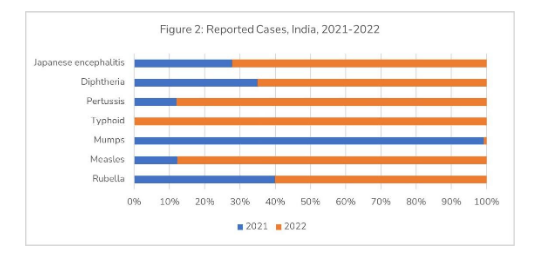

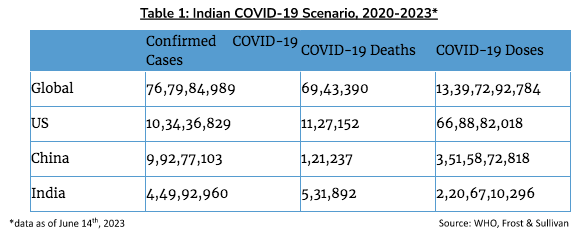

India has administered over 2.2 billion doses of the COVID-19 vaccine, and the cases have declined steadily. Despite being poised to be the world’s most populous country in 2023, India’s cumulative confirmed cases of COVID-19 remain lower than that of the US and China (refer to Table 1).

The leading reason for not getting vaccinated in India largely was due to the fear of side effects, as it is a newly introduced vaccine. However, as the increased vaccine dose has led to a decline in COVID-19 cases and mortality, the data is likely to bolster improved trust in Indian citizens and increase its uptake in the subsequent years.

Indian vaccine innovation landscape

The COVID-19 pandemic saw the emergence of several indigenous vaccines in India. Bharat Biotech’s Covaxin, an inactivated vaccine and Zydus Cadila’s Zycov-D, a DNA vaccine, were both approved by the Drug Controller General of India (DCGI). India is also developing its first indigenous mRNA vaccine, HGC019, which is being made by Gennova, Pune, in collaboration with HDT Biotech Corporation, US. Other indigenous vaccines in clinical development include Biological E’s BECOV (protein subunit vaccine), Bharat Biotech’s BBV154 (non-replicating viral vector vaccine), and Aurobindo’s UB-612 (protein subunit vaccine). Other global manufacturers who received COVID-19 vaccine approvals in India include Serum Institute of India (SII)/AstraZeneca/Oxford, Moderna, Gamaleya, and Janssen. Within the Indian population, Covishield and Covaxin were some of the most administered vaccines.

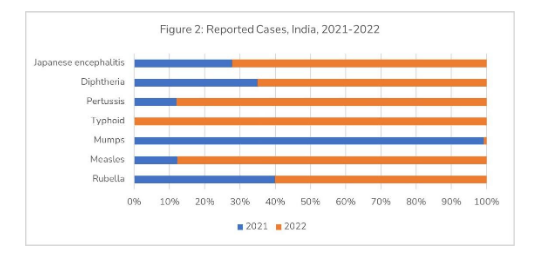

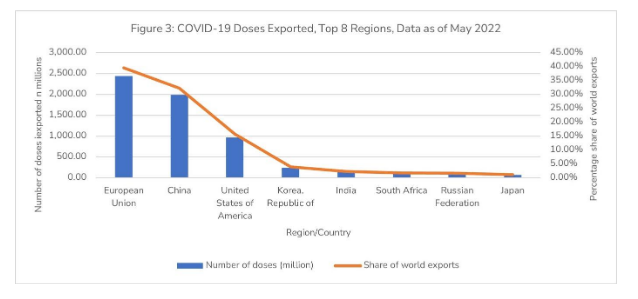

India is also an exporter of COVID-19 vaccines. As of May 2022, India exported about 140.2 million COVID-19 doses to the world, accounting for about 2.3 per cent of the global COVID-19 vaccine export share (Figure 3). The Union Ministry of External Affairs (MEA), India, reported that SII’s Covishield accounted for over 66 per cent of the total COVID-19 exports from India. For instance, SII’s Covovax was exported to the Netherlands, and SII’s Covishield to Brazil.

Several COVID-19 vaccine candidates are currently undergoing clinical development in India. While most of them are protein subunits and inactivated vaccines, India is likely to witness upcoming regulatory approvals for RNA vaccines as the next emerging technology segment within the COVID-19 space. Some of the key emerging innovators in this space include Bharat Biotech, Biological E, Gennova, and Aurobindo.

The way forward

The COVID-19 pandemic accelerated the development, manufacture, and distribution of vaccines at an unprecedented speed and scale. Global collaborations and rising political pressures were able to shorten the vaccine development time to less than a year as opposed to the standard 10-year time frame. While this was beneficial in the clinical management of the pandemic, the shortened time was often not sufficient to achieve optimal efficacy rates.

For instance, Covaxin had an efficacy rate of about 78 per cent and Moderna’s mRNA vaccine had a low antibody titer against the beta-variant of the virus. Furthermore, the efficacy of the COVID-19 vaccines was not fully tested against the new SARS-CoV-2 variants such as delta and omicron. COVID-19 distribution equity across global economies and the impact of COVID-19 vaccination for children were also some of the major causes of global concern and WHO is currently looking to improve vaccine distribution equity globally.

Although 3 vaccines, namely, Corbevax, Covaxin and Covovax, received emergency use regulatory approvals for use in children between 5 and 12 years of age, there is still a lot of concern regarding the long-term impact and side effects of the vaccine in that age group. There is also a need to study the impact of co-morbidities during the administration of COVID-19 vaccines. Additionally, the impact of COVID-19 vaccines should be studied in pregnant women and infants. Rigorous post approval monitoring of COVID-19 vaccines across different population age groups and demographics will help alleviate the rising concerns for COVID-19 vaccines and help develop more effective products in the future.

India also needs to decrease its large dependency on China for API (active pharmaceutical ingredients) manufacturing to emerge as a stronger leader in the global vaccine industry. The Indian government needs to increase its R&D spending and create a favourable local environment for end-to-end vaccine innovation and manufacturing. Adding innovative vaccine delivery platforms, such as a common viral vector or cell-based delivery platforms, to India’s growing vaccine portfolio can also help scale production. Regulatory frameworks should also be redesigned to include platform-based approvals. Then, a single approved platform can be utilised to develop multiple vaccine products, thereby accelerating market entry through a streamlined regulatory process.

Furthermore, India’s non-COVID-19 vaccine portfolio is largely restricted to LIC (low-income country), and LMIC (lower middle-income country) sectors. There is a need to tap into HIC (high-income country) markets to accelerate growth in this sector. The Indian vaccine industry should explore technology transfer and contract manufacturing opportunities for vaccines such as conjugate vaccines, pneumococcal vaccines, and rotavirus vaccines to enter the HIC segment. Furthermore, novel applications should also be explored. For instance, vaccines are also likely to enable disease treatment, in cases such as norovirus and HIV infections. These opportunities should be explored further for the growth of the Indian vaccine sector.

International collaborations can also help improve the production and delivery of vaccines at an affordable rate. For instance, the collaboration among the SII, the Bill & Melinda Gates Foundation, and GAVI accelerated the development and delivery of about 200 million COVID-19 vaccine doses at the cost of about $3 per dose. There is a need to develop a process that formalises such collaboration going forward and enables accelerated response to endemics and/or pandemics.

Global vaccine manufacturing is largely restricted to large pharmaceuticals such as Pfizer, Sanofi, GSK, and Novartis. However, IP licensing programmes and modular manufacturing approaches can enable Indian manufacturing of global vaccines and thereby provide improved access. Indian public and private sectors should explore these strategies to grow in this industry sector.

The public sector manufacturing capacity in India remains underutilised. According to the National Health Profile of the Government of India, the share of the public sector share in total installed capacity decreased from 22.8 per cent in 2006 to about 10.2 per cent in 2019. This was also accompanied by a steep decline in public sector demand for Universal Immunisation Programme (UIP) vaccines. The government also began to direct UIP vaccine demand to the private sector, which now accounts for over 95 per cent of the UIP demand. However, there are only about 25 vaccine manufacturers, and they are unlikely to meet the rising demand for vaccines in the coming years through indigenous manufacturing hubs. Hence, India will continue to rely increasingly on imports for vaccine demands.

While India’s vaccines provide greater value for money when compared to its global counterparts and enabled its exports to low- and middle-income economies, COVID-19 adversely impacted India’s position as a global vaccine exporter. It also provided an opportunity for China to emerge as one of the leading participants in the global vaccine landscape.

However, the pandemic also fueled Indian manufacturers such as Bharat Biotech to develop novel vaccines and enter the global vaccine market. There are several other indigenous participants that are developing novel vaccines across newer technology segments, such as mRNA vaccines for COVID-19. Growing participation from the public sector and the optimal utilisation of India’s manufacturing capabilities can not only enable India to become self-sufficient but also help India regain its dominant position in the global vaccine market.

Vandana Iyer, Industry Principal- Health & Wellness, TechVision, Frost & Sullivan