Mobile health garnered $282 million in venture capital funding

May 04, 2015 | Monday | News | By BioSpectrum Bureau

Mobile health garnered $282 Million in venture capital funding

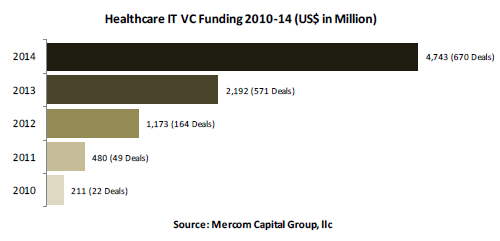

VC funding in health IT shows significant increase globally. (Source: Mercom Global Report)

Funding into Healthcare Information Technology and Digital Health companies in Q1 2015 totaled $784 million in the first quarter of 2015.

As per the data generated through its latest report, the Mercom Global has revealed that the mobile health (mHealth) companies accounted for 36 percent of total funding raised by digital health / health IT companies this quarter and also received the largest share (65 percent) of funding among consumer-focused companies, with $282 million in 56 deals (compared to $284 million in 41 deals in Q4 2014).

Though funding fell across all technology groups this quarter, mHealth was the only area where funding levels did not decline significantly compared to the previous quarter. A total of 112 investors participated in mHealth funding rounds in Q1. GE Ventures was only investor that participated in multiple deals.

Within mobile health, mHealth App companies captured the largest share bringing in $220 million in 35 deals. Last month, the Food and Drug Administration released the final guidance on mobile medical apps, bringing some much needed clarity and certainty to the mobile health market. The final guidance confirms a light, hands-off approach to regulating mhealth apps.

Mobile health companies have received more than $2 billion in over 500 deals since 2010. Mobile health apps, in particular, have received about $900 million in more than 280 deals since 2010.

Care-focused apps led with the most deals followed by fitness/wellness/nutritions apps. The focus of care apps that received funding ranged from diabetes, cancer, parkinsons, cardiac health, chronic disease care and medication tracking among others.

Some significant deals this quarter included Advance Health, a provider of a mobile patient data capture application for managed care providers, which raised $40 million from Summit Partners and Noro-Moseley Partners. ClassPass, a mobile membership app offering unlimited fitness and wellness classes across multiple gyms and studios to make working out more accessible also received $40 million from General Catalyst and Thrive Capital.

Clinical Ink, a provider of point-of-care mobile data capture application for clinical trials, raised $20 million from MPM Capital, F2 Ventures, FCA Venture Partners and other investors. Glooko, a provider of an FDA-cleared mobile diabetes management app and a metersync device, received $16.5 million from Medtronic, Canaan Partners, The Social + Capital Partnership and Samsung's venture investment arm. Noom, a developer of health and fitness apps, raised $16.15 million from Han-Sing Hi-Tech Fund, TransLink Capital and RRE Ventures.

Wearable Sensor companies logged $42 million in nine deals. A range of wearables including patches, bands, neckwear, implantable and disposable sensors were funded this quarter. Some large deals included Orthosensor, a company that develops sensor-based disposable orthopedic implants to help surgeons optimize placement of artificial knees and other clinical decisions, raised $19 million from Bridger Healthcare and Tullis Growth Fund. GlySens, a developer of a fully-implanted sensor-based continuous glucose monitoring system for people with diabetes, raised $12 million.

Peerbridge Health, a developer of a wearable wireless vital sign monitoring sensor that provides heart rate and heart rhythm information to consumers, raised $4.89 million.

Sproutling, a provider of a wearable health monitor designed for a baby's ankle, raised $4 million from BoxGroup, Forerunner Ventures, FirstMark Capital, First Round Capital, Lemnos Labs, Accelerator Ventures and Napster co-founder Shawn Fanning.

Mobile Wireless technology companies with products like a wireless thermometer, a Bluetooth glucometer, wireless ECG and others recorded $21 million in 12 deals. Top deals included Atheer Labs, a provider of gesture-based 3D wearable smart glasses for use as a hands-free platform in operating rooms as well as to access medical records, which raised $8.8 million.

Palo Alto Health Sciences, a developer of an FDA-cleared, at-home breathing system that trains individuals diagnosed with panic disorder to control their breathing and respiration, raised $3.9 million. Monica Healthcare, a fetal monitor developer, raised $3 million from Catapult Ventures, The New Hill Growth Fund, East Midlands Business Angels, The University of Nottingham, Wren Capital, Origin Capital, Catamaran Ventures and the London Business Angels, and other investors.