Aditya Birla Health Insurance joins hands with Paytm

January 08, 2020 | Wednesday | News

On Paytm platform, various covers related to SMOG care , Cancer care, Cardiovascular care , Dental care, Diabetes and Common communicable disease care are available.

Aditya Birla Health Insurance Co. Limited. (ABHICL), the health insurance subsidiary of Aditya Birla Capital Limited (ABCL), a significant non-bank financial services’ conglomerate, announced its partnership with Paytm, India's leading payment gateway to promote bite sized group health insurance products for Paytm’s 130 million active customers across the country.

Bite-sized insurance cover, also known as sachet insurance, is available with hassle-free documentation process as compared to traditional health insurance products. These products are tailored as per the needs of working professionals and millennials. Bite sized products are popular among customers who are seeking health plans at an affordable low price for their specific health needs.

The whole idea behind this partnership is to make health insurance extremely affordable and instantly available to the people. Aditya Birla Health Insurance in association with Paytm will offer a host of innovative offerings, including unique covers like common communicable illness cover, dental cover, diabetes cover and cancer cover with premium starting as low as Rs 149.

Additional benefits

· No paperwork needed - No medical required

· Immediate policy issuance at affordable premium

· Fully digitally enabled enrolment journey - get health insurance in just2-clicks

Speaking on the announcement Mr. Mayank Bathwal, CEO, Aditya Birla Health Insurance Co, Ltd. said, “At Aditya Birla Health Insurance, our endeavour is to provide need-based health insurance solutions to our trusting customers. We are acknowledged for our product innovation, customer engagement, and technology advancements. Our association with one of the leading payment aggregators Paytm, further strengthens our commitment to make quality health insurance products more affordable and conveniently accessible to millions of customers across India through digital innovations.”

He further added, “With this partnership, we look forward at extending our health insurance solutions through Paytm’s robust presence across the country backed by technological innovations

Speaking on the announcement Mr. Amit Nayyar, President, Paytm said, "We are deeply focused on offering innovative and customized insurance solutions to our millions of customers. We are looking to simplify the journey for customers from purchase to claim process. Offering need based bite sized-products in simplified digital mode helps customers to get insured easily and increase insurance penetration in India. This partnership further strengthens our ability to offer innovative products to our customers."

List of health covers available on Paytm platform:

|

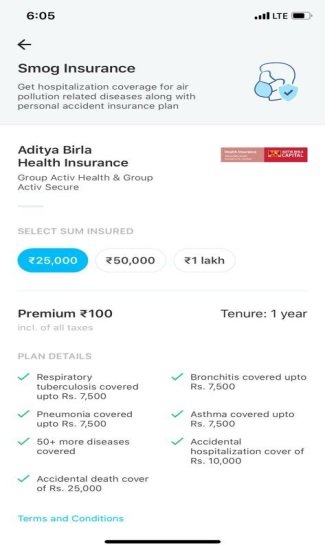

For SMOG Care : Group Activ Health and Group Activ Secure

covers Respiratory tuberculosis, Bronchitis, Pneumonia, Asthma +50 more diseases along with accidental death & hospitalization cover

|

Key Features

|

18-60 years

|

|

1-year tenure can be bought for as little as Rs. 100

|

|

Users have other options for increased sum-insured of 50,000 &1 lakh at premium of Rs. 200 & Rs. 400 respectively

|

|

For Cancer Care : Group Protect

|

Key Features

|

Individual cover for 18-60 years with premium starting as low as Rs. 199 only

|

|

1 year Comprehensive cancer cover (fixed benefit) for all 3 stages of Cancer

|

|

SI options up to 10 lakhs

|

|

For Cardiovascular Care : Group Protect

|

Key Features

|

1-year cover can be opted from 1 to 5 lakhs SI with starting premium of Rs. 499/-

|

|

For Common Communicable Diseases Care : Group Activ Health

Malaria, Dengue, Typhoid, Tuberculosis and Tetanus

|

Key Features

|

Premium starting at Rs. 149 for the year

Hospitalisation benefits upto Rs. 20000/-

|

|

For Diabetes Care: Group Activ Health

covers OPD test for RBS, unlimited tele/chat OPD consultation for1 year

|

Key Features

|

Two SI options of 25000 & 50000 are available at starting premium of Rs. 929

Comprehensive in-patient cover with SI reload option

|

|

For Dental Care : Group Activ Health

|

Key Features

|

OPD expenditure on scaling & filling upto Rs. 150 along with major dental procedures covered for inpatient hospitalisation for one year.

|