'Healthcare IT VC funding in 2015 plateaus at $4.6 billion'

January 19, 2016 | Tuesday | News | By BioSpectrum Bureau

'Healthcare IT VC funding in 2015 plateaus at $4.6 billion'

Mercom's comprehensive report covers deals of all sizes across the globe

Mercom Capital Group, a global communications and consulting firm, released its annual report on funding and mergers and acquisition (M&A) activity for the Healthcare Information Technology (IT) / Digital Health sector in 2015. Mercom's comprehensive report covers deals of all sizes across the globe.

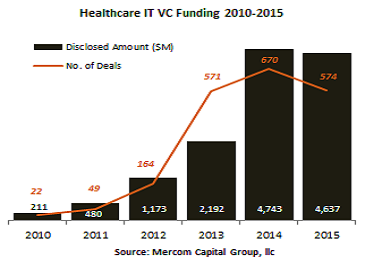

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT sector totaled $4.6 billion in 574 deals in 2015, slightly below 2014's record $4.7 billion in 670 deals - still a big year for the sector. Total corporate funding in Health IT companies including debt and public market financing (including IPOs) came to $7.9 billion this year, up slightly compared to $7.8 billion in 2014.

As per the report, since 2010, the sector has received $13.4 billion in VC funding in 2,050 deals and almost $7 billion in debt and public market financing (including IPOs), bringing the total funding for the sector to $20.4 billion.

"After an incredible run from 2010-2014, VC funding into Health IT companies leveled off last year. We are beginning to see a slow down in early stage deals, a sign the sector is beginning to mature. We are also seeing funding trends shift from practice-focused to consumer-focused technologies and products," commented Mr Raj Prabhu, CEO and co-founder of Mercom Capital Group. He added, "Apart from innovative technologies and solutions, business and revenue models are becoming more important."

VC funding dipped in Q4 2015 with $1.1 billion in 145 deals compared to $1.6 billion in 148 deals in Q3 2015, says report.

Practice-centric companies raised more than $1.5 billion in 171 deals in 2015, down from $2.4 billion in 234 deals last year. Top funded areas included - Data Analytics companies with $294 million, followed by Clinical Decision Support companies with $220 million and Practice Management Solutions companies with $183 million.

Consumer-centric companies grossed about $3.1 billion in 403 deals, up from $2.3 billion in 436 deals last year. Mobile Health (mHealth) companies raised the most funding with more than $1.1 billion. Most of the funding within the mHealth category went to mHealth Apps with $750 million and Wearables/Sensors with $277 million. Rating and Comparison Shopping companies received more than $1 billion followed by Telehealth companies with $468 million.

The areas with the highest YoY growth in funding were Comparison Shopping with 615 percent, Scheduling and Appointment Booking with 370 percent and Wellness with 126 percent.

The top VC funding rounds in 2015 were Chinese company Guahao's raise of $394 million, NantHealth's $200 million round, ZocDoc's $130 million raise, followed by Virgin Pulse's $92 million raise. India's Practo was next with a $90 million round, Collective Health raised $81 million and Health Catalyst brought in $70 million.

A total of 909 investors participated in VC funding rounds for Healthcare IT companies in 2015 compared to 732 in 2014. The top VC investors in 2015 were New Enterprise Associates and Rock Health with nine deals each, followed by Merck Global Health Innovation Fund and Venrock with eight deals each.

Mobile Health Apps had the most M&A transactions with 22, followed by Practice Management Solutions with 18 transactions, Data Analytics companies with 17, EHR/EMR companies with 16 and Telehealth companies with 11.

There were seven Digital Health IPOs this year, raising $2.2 billion. Fitbit raised $841.2 million, followed by Inovalon with $600 million, Press Ganey Associates with $256 million, Evolent Health with $225 million, Teladoc with $180 million, MINDBODY with $100.1 million and Adherium with $25.6 million.