VC funding in healthcare IT to exceed $2 billion in 2013

July 22, 2013 | Monday | News | By BioSpectrum Bureau

VC funding in Healthcare IT to exceed $2 billion in 2013

Mercom Capital Group, llc, a global communications and consulting firm, recently released its report on funding and mergers and acquisitions (M&A) activity in the Healthcare IT sector for the second quarter of 2013.

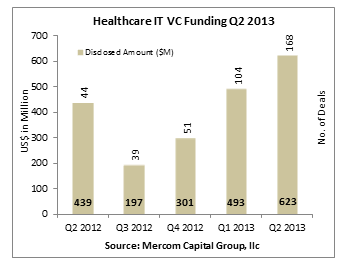

According to the report, venture capital (VC) funding in the sector continued its rapid growth in another record quarter with $623 million raised. There were 168 funding deals this quarter compared to 104 the previous quarter and 163 in all of 2012.

"VC funding in Healthcare IT is now on pace to exceed $2 billion in 2013," commented Raj Prabhu, CEO of Mercom Capital Group. "What government financial incentives did to spur EHR adoption and practice-focused technologies, "open data" is doing for consumer-focused companies that turn data into usable applications and services."

The impact of healthcare data on innovation, products and private investments is evidenced in Mercom's Q2 2013 report. The marked shift of VC money going from practice-focused technologies towards consumer-focused technologies in Q1 has picked up pace this quarter with consumer-focused companies receiving twice the amount of funding ($416 million in 112 deals) compared to practice-focused companies ($207 million in 56 deals).

Proteus Digital Health, a digital health feedback system provider, raised $45 million to make it the largest recipient of funding. lifeIMAGE, a network for securely sharing medical images and related health information, raised the second highest amount in the second quarter when it closed a $35.6 million Series C round. Blue Health Intelligence, a healthcare data and analytics company, raised $35.5 million. WorldOne brought in $35 million and Watermark Medical, closed out the Top 5 with $32.2 million.

The two disclosed M&A transactions in Q2 2013, included Jawbone, expanding its long line of recognizable wearable devices, which acquired BodyMedia, a maker of wearable health tracking devices, for more than $100 million. The other was Instem, a provider of IT applications to the early development healthcare market, which acquired Logos Holdings, a provider of full-service electronic data capture for clinical research organizations, along with its subsidiaries Logos EDC Solutions and Logos Technologies, for $7.7 million.

A total of 161 investors participated in Q2 2013 including accelerators, incubators and crowd-funding platforms compared to 108 different investors in Q1 2013. Eleven investors participated in multiple funding rounds in Q2 2013. Ascension Health Ventures was the most active investor, and participated in three deals. The remaining top investors participated in two deals apiece. They included BlueCross BlueShield Venture Partners, AIB Seed Capital Fund, Cardinal Partners, Enterprise Ireland, Galen Partners, Khosla Ventures, Lemhi Ventures, Milestone Venture Partners, New Enterprise Associates, and SV Angel.

Consumer-focused companies specializing in apps, wearable devices, sensors, remote monitoring, patient engagement, rating/shopping, and social health networks for physician-to-physician, physician-to-patient and patient-to-patient were all prominent this quarter, whereas medical imaging, data analytics and EHR/EMR companies were among the practice-focused technologies that received attention this quarter.

M&A activity in the Healthcare IT sector dropped in Q2 2013 with 30 transactions of which only two were disclosed compared to Q1 2013, with 46 M&A transactions of which only five were disclosed. Health information management companies attracted the most acquirers with 14 transactions followed by service providers with seven acquisitions and mobile health with three in Q2 2013.