AI and biotechnology lead funding in India, with advanced materials emerging: Report

February 16, 2024 | Friday | News

Today’s deep science is tomorrow’s mainstream tech, reveals The India Deep Science Tech Report

The India Deep Science Tech report is an in-depth analysis of the latest investment trends in the sector. For the first time ever, Ankur Capital and Tech Sprouts provide a ringside view of building IP-led technology companies from seed to commercial scale.

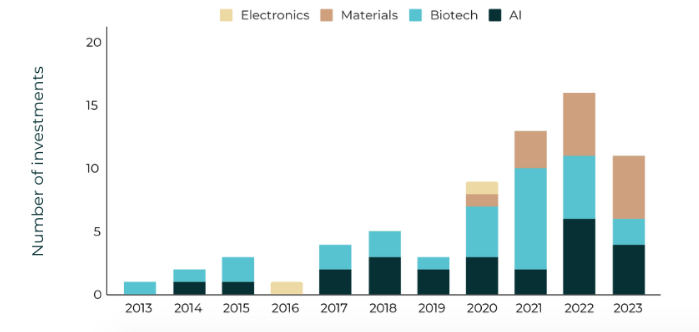

Deep science tech innovations are driven by fundamental advances in four fields: Artificial Intelligence (AI), Biotechnology, Advanced Materials and Electronics & Photonics. The new report deep dives into the investment trends, key breakthroughs in the space, and emerging opportunities in each technology vertical.

The report reveals that AI and biotechnology have historically dominated India's funding landscape (80% of total investments since 2010), with advanced materials gaining momentum in recent years.

Investments in India's biotechnology sector surged post COVID-19, with nearly $900 million allocated between 2013-2023, driven by a focus on therapeutics, diagnostics, and sustainable agri-food technologies. Key investments include Molbio Diagnostics' and Bugworks'. The agri-food industry has seen growth in innovations like biostimulants and alternative proteins, with notable investments in companies like String Bio and Sea6 Energy. M&A, particularly in the pharmaceutical sector, offer exit pathways in the sector.

Recent years have seen a notable increase in follow-on funding for early AI ventures, with 2022 witnessing five investments exceeding $10M, underscoring a growing interest despite a slowdown in fresh investment. Indian deep science AI companies have predominantly focused on spectral image and genomic data analysis for applications ranging from diagnostics to robots to satellite imagery.

According to the report, investment in deep science tech startups has consistently doubled every three years since 2010, with projections to surpass $10 billion by 2029, indicating robust growth and investor confidence.

The number of investment rounds exceeding $5 million has doubled every three years. Since 2017, follow-on rounds have outpaced fresh funding, signaling investor commitment to doubling down on scale-up.