Can phased trade margin rationalisation boost pharma growth?

September 20, 2024 | Friday | News | By Bhagwati Prasad

The pharma representatives of the Laghu Udyog Bharati, an RSS affiliate and a not-for-profit Pan India Organisation with the aim of empowering Micro and Small enterprises in the country since its formation in 1994, on July 24, had a meeting with officials from the Department of Pharmaceuticals, and discussed key issues such as Trade Margin Rationalisation (TMR), Schedule-M extension, Revised PTUS Hurdles, and the Drug Tribunal Board formation. LUB Pharma proposed the innovative "One Nation-One Molecule-One MRP" and advocated for the top 100 companies to sell their generic brands at molecule name and affordable Maximum Retail Price (MRP) for patient benefits. Here we are looking at series of recommendations from industry associations to make TMR more effective, balanced, and supportive of all stakeholders in the pharmaceutical supply chain.

The pharmaceutical industry has called for a careful and phased implementation of Trade Margin Rationalisation (TMR), urging the government to ensure that the Drug Price Control Order (DPCO) is equipped to meet future challenges while fostering industry growth. Leading industry associations have put forward a series of recommendations to make TMR more effective, balanced, and supportive of all stakeholders in the pharmaceutical supply chain.

However, the industry is cautious about expanding TMR across the pharmaceutical sector, recognising the complexities involved. Industry associations have noted that while TMR is a promising tool for ensuring fair pricing, it must be applied in a manner that avoids unintended consequences such as supply chain disruptions, reduced market access, or the undermining of small and medium-sized enterprises (MSMEs).

Recognising the importance of a robust and future-ready DPCO, industry leaders have outlined key recommendations for how TMR should be implemented to achieve the desired balance between affordability and industry growth. These recommendations focus on maintaining a healthy supply chain while protecting the interests of consumers and MSMEs alike.

Industry stakeholders have called for TMR to be implemented in phases, with a focus on high-value, non-scheduled formulations as a starting point. The roll-out should be prospective, applying only to batches manufactured after the notification is issued, and stakeholders should be informed of TMR guidelines 3 to 6 months in advance. This phased approach would allow companies to adjust to the new regulations without major disruptions.

Exemptions for Key Sectors: The industry has recommended that certain areas of the pharmaceutical market be exempt from TMR. Specifically, Para 19 drugs (those critical to public health), government tender businesses, and patient assistance programs should not be included in the scope of TMR. These sectors often operate under different financial models and regulatory frameworks, making them unsuitable for margin rationalisation measures.

Simplification of Compliance via IPDMS: To streamline the regulatory process, the industry has requested that Form V price lists, which track the revised prices of drugs, be submitted exclusively through the Integrated Pharmaceutical Database Management System (IPDMS). This would eliminate the need for multiple submissions and reduce the administrative burden on manufacturers.

Price Revision Based on Para 20 Guidelines: The industry proposes that price revisions under TMR should adhere to Para 20 of the DPCO, which requires revisions to be based on the average of the preceding 12 months. This approach will help ensure that price adjustments are reflective of market conditions and are not overly disruptive to manufacturers and wholesalers.

Industry associations have also underscored the importance of protecting MSMEs, which play a significant role in the pharmaceutical sector. TMR should be applied in a manner that considers the unique challenges faced by these smaller companies, which may lack the financial resources to absorb sudden margin changes.

TMR in Practice

TMR, if implemented effectively, could lead to a significant restructuring of the pharmaceutical market. The pilot phase with cancer drugs has demonstrated that margin rationalisation can lead to lower prices for consumers, but the broader implications of extending it to other drugs remain a matter of debate.

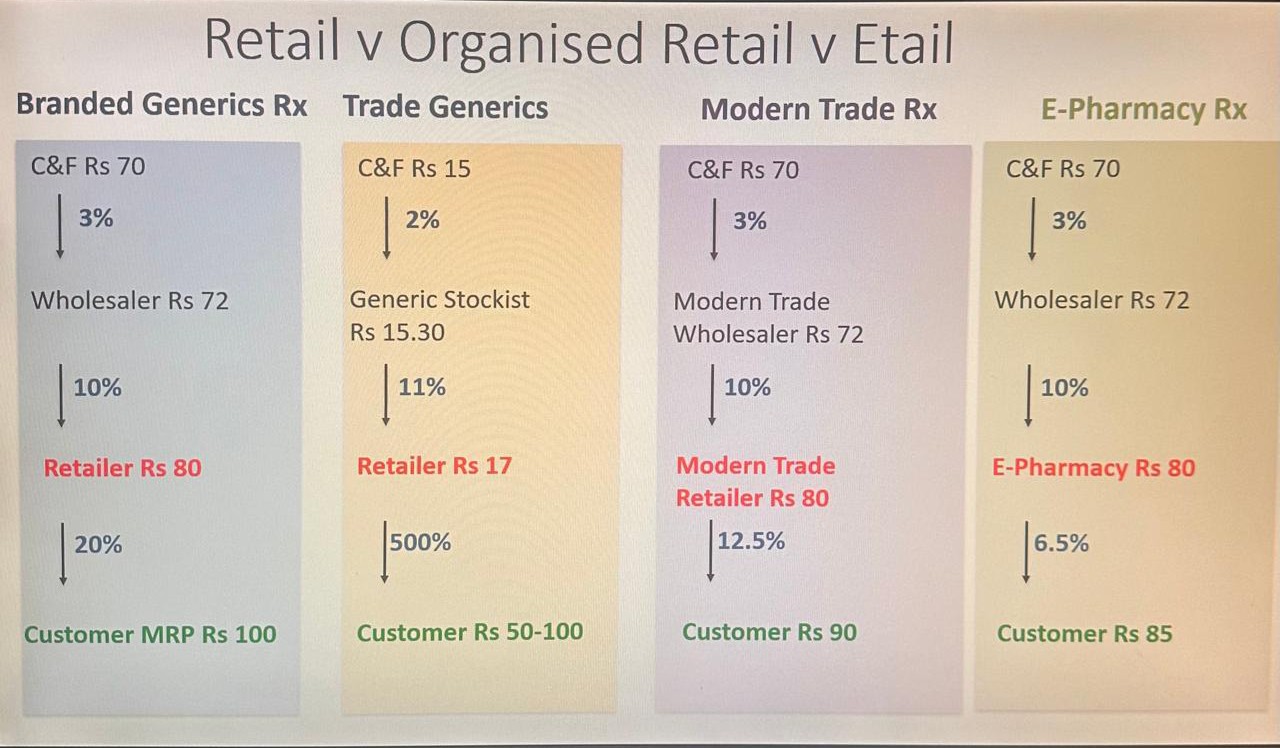

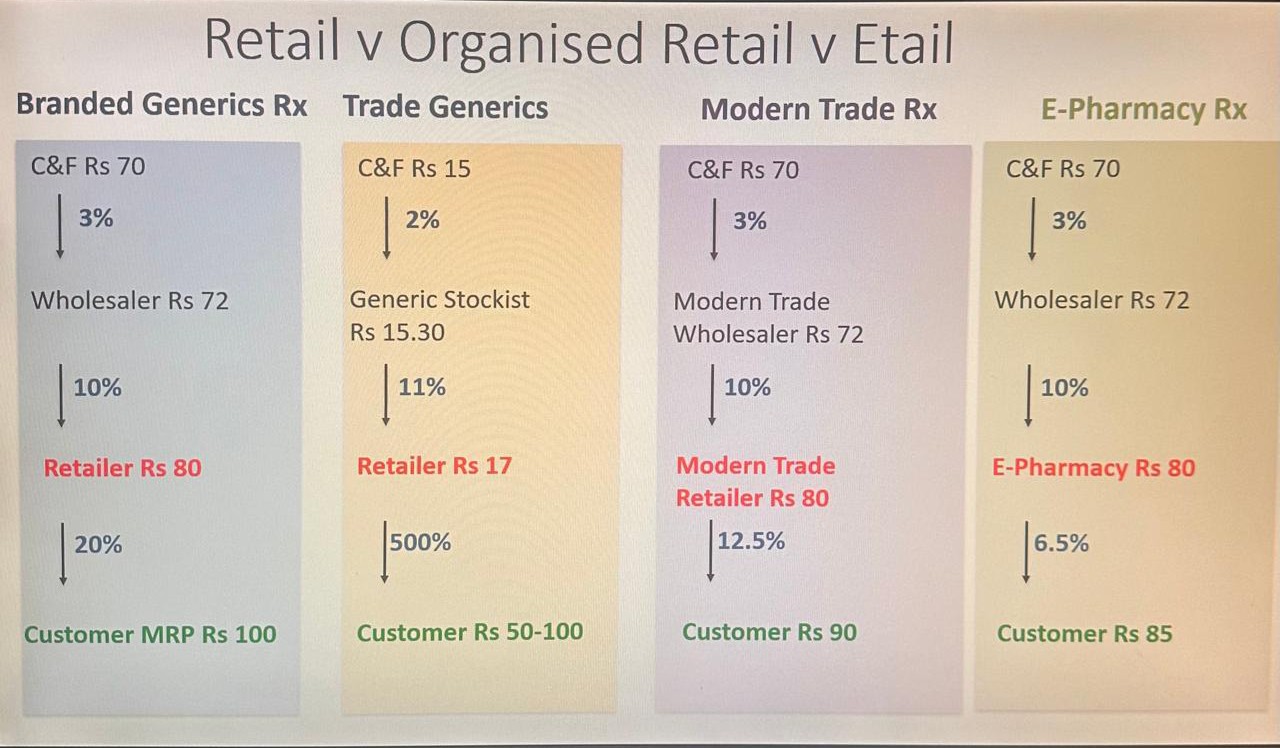

The pharmaceutical industry is undergoing significant transformation as different retail models, including traditional retail, organised retail, and e-pharmacies, compete for market share. A recent analysis comparing the trade margins across these channels has highlighted the discrepancies in pricing and profitability at various stages of the pharmaceutical supply chain.

Branded Generics Rx: Traditional Retail Model

The traditional retail model for branded generic drugs is structured with multiple layers in the supply chain. The cost-and-freight (C&F) agent typically charges Rs 70, with a 3 per cent margin passed on to the wholesaler, who then charges Rs 72, taking a 10 per cent margin. Finally, the retailer charges Rs 80, with a 20 per cent margin. This results in a maximum retail price (MRP) for the customer of Rs 100.

Trade Generics: A disruptive force in the market

Trade generics, which are off-patent drugs sold under their chemical names rather than brand names, present a drastically different picture in terms of pricing and trade margins. In this model, the C&F margin is much lower at Rs 15, with a 2 per cent margin. The generic stockist takes Rs 15.30 with an 11 per cent margin, while the retailer charges Rs 17, reflecting a significant 500 per cent. The organised retail model offers a more structured pricing system, with slightly different trade margins than traditional retail. Here, the C&F agent again takes Rs 70 with a 3 per cent margin, and the modern trade wholesaler charges Rs 72 with a 10 per cent margin. However, modern trade retailers charge Rs 80 with a lower margin of 12.5 per cent, leading to a customer price of Rs 90, offering a more competitive price than traditional retail.

E-Pharmacies as digital disruptor

E-pharmacies have emerged as a major disruptor in the pharmaceutical industry, offering consumers greater convenience and competitive pricing. In this model, the C&F agent again charges Rs 70 with a 3 per cent margin, while the wholesaler takes Rs 72 with a 10 per cent margin. However, e-pharmacies take Rs 80 with a lower margin of 16.5 per cent, leading to a final customer price of Rs 85. This model offers some of the lowest prices for consumers, thanks to reduced overhead costs and streamlined distribution.

As the industry shifts towards more organised and digital models, consumers stand to benefit from lower drug prices, though this also poses challenges for traditional retailers who must adapt to these new competitive pressures. Ensuring that TMR is future-ready means protecting the interests of consumers, encouraging innovation, and safeguarding the livelihood of small businesses.

Bhagwati Prasad