India breaks into top 10 in Cytiva’s 2025 Global Biopharma Index

October 30, 2025 | Thursday | News

India climbs five places in global ranking, driven by growing R&D capacity and generics strength

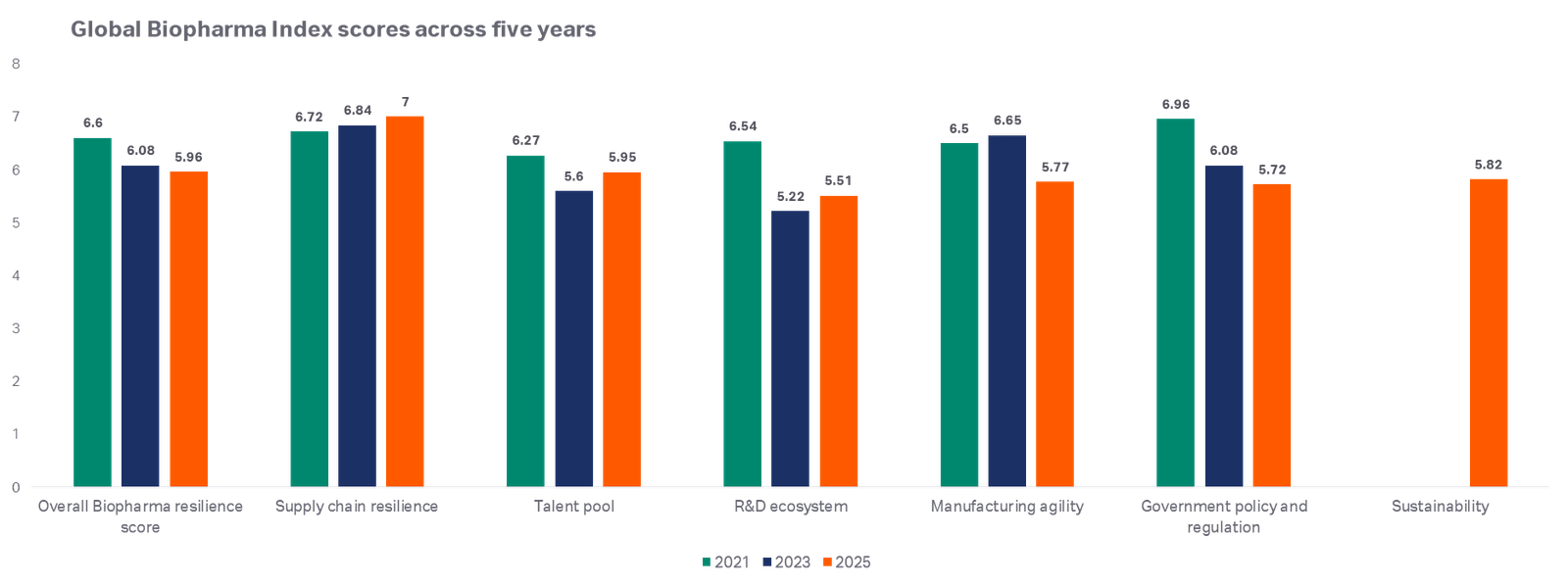

Cytiva, a Danaher company and a leader in the life sciences industry, has released the third edition of its Global Biopharma Index. Every two years, Cytiva surveys 1250 biopharma executives across 22 countries and asks them to rate, on a scale of 0 to 10, the biopharma ecosystem across six pillars: supply chain resilience, talent pool, R&D ecosystem, manufacturing agility, government policy and regulation. Sustainability is a new pillar in the 2025 survey.

The latest edition shows India climbing into the top ten globally - rising from fifteenth place in 2023 to tenth in 2025. India’s index score improved to 6.04, up from 5.95 in 2023, marking one of the most notable jumps among emerging economies. The report highlights sustained investment in R&D and a robust generics manufacturing capacity as key contributors to India’s rise.

Manoj Kumar R Panicker, General Manager of South Asia, Cytiva says: “India’s biopharma ecosystem is evolving rapidly, with biosimilars emerging as a strategic lever for global impact. As policy and regulatory frameworks continue to mature, Cytiva is committed to enabling this momentum - through advanced digital technologies, skill development, and partnerships that help scale affordable biologics and sustainable innovation.”

An in-depth look at the six pillars of resilience globally

- Supply chain resilience is improving with 55% of executives stating they believe their country’s biopharma supply chains are more robust than 12 months ago. However, more than a quarter surveyed said their supply chain was not equipped to support advanced modalities such as cell and gene therapies. 76% predict that geopolitical volatility will significantly impact their sourcing strategies, while 56% agree that domestic manufacturing of biologics is set to increase dramatically over the next three years.

- The talent pool has improved slightly but continues to be a challenge for the biopharma industry. Approximately one third of executives reported severe or critical shortages in key areas associated with advanced drug modalities, such as cell and gene therapies, mRNA, and antibody drug conjugates (ADCs), sustainability, manufacturing, digital, and AI skills.

- The R&D Ecosystem pillar is stronger than it was 2023. Countries that score highly on this pillar are more likely to bring therapies to market faster. Collaboration is key to a strong R&D ecosystem and nearly half of respondents said it remains difficult to find high quality partners, such as CROs/CDMOs, academic research institutions, and government labs and think tanks.

- Manufacturing agility is central to biopharma’s ability to respond to changing demand. 2025 data shows that many firms lack the ability to scale production quickly. One in four executives surveyed said their organization would be slow or very slow to ramp up manufacturing of hormone-based products, mRNA vaccines, and cell and gene therapies.

- Government policies and regulation are critical to the biopharma industry. However, our data shows that many executives struggle with fragmented, unpredictable policy environments. 51% say government policy is inconsistent and 50% say it is now harder to raise capital due to current market conditions.

- Sustainability is a strategic priority across many industries but almost half of biopharma executives report that their company fails to achieve its sustainability targets. Nearly two-thirds say their company deprioritises sustainability due to short-term financial pressures and competing business priorities. 34% report talent shortages in sustainability roles.