Biopharma Chromatography: Segregating Opportunities of all Sizes

March 01, 2025 | Saturday | Views | By Aditya Joshi, Co-Founder and Marketing Head, Stratview Research

Chromatography systems are essential in a variety of fields, including the biological sciences. Biopharma accounts for almost 30 per cent of this market, making it a key sector for chromatography systems. The main forces behind India's dominant market position would be the enabling government policies and the growing number of foreign research and industrial contracts. Beginning in 2028, India will create a demand for more than 1000 biopharma chromatography systems yearly.

Chromatography systems play a critical role across different industries, in processes like drug development, nutritional analysis, toxin detection, pollutant analysis, among others. This being one of the most preferred methods for the separation and purification of compounds across the aforementioned industries, its market share is worth $10+ billion as of 2025. Approximately 30 per cent of this market is driven by biopharma, making it a cornerstone industry for chromatography systems.

Biopharma Chromatography Market

Ever since the outbreak of COVID-19, the world has been on its toes regarding healthcare operations. Governments and the public have become more alert towards healthcare facilities and 2020 can be seen as a landmark year that reshaped several trends within the healthcare sector, including chromatography.

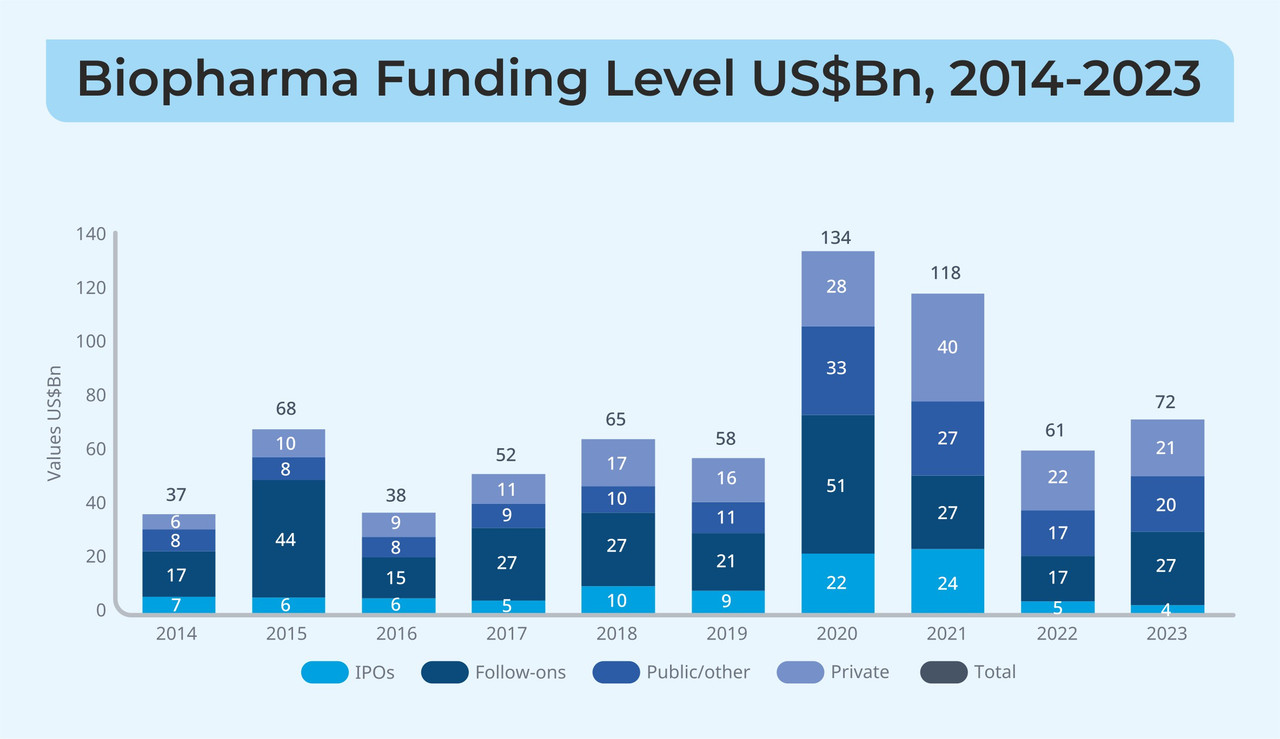

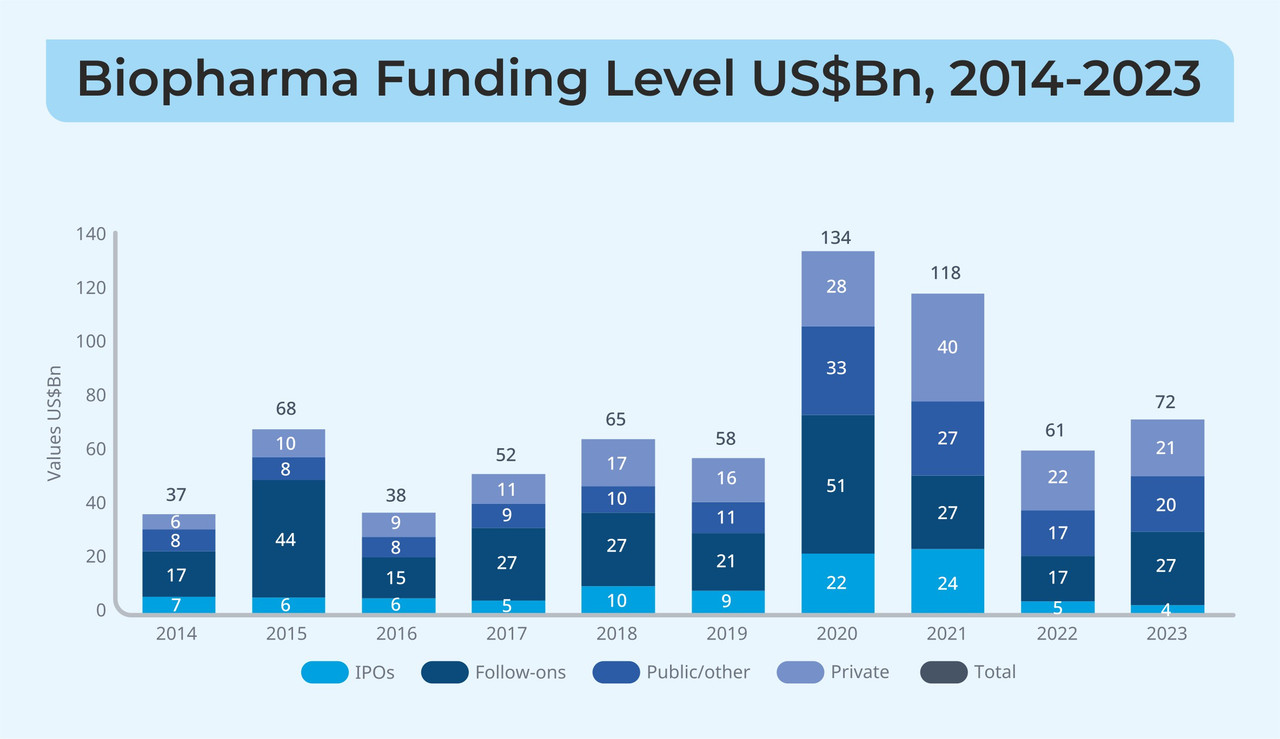

To tackle COVID-19 at its peak, the year 2020 saw the highest increase (>10 per cent higher compared to 2019) in global healthcare spending and the Biopharma sector saw its highest ever ~130 per cent increase in funding from $58 billion in 2019 to ~$134 billion in 2020. For chromatography systems specifically, the pandemic led to an increased usage of single-use systems (SUS) to avoid cross-contamination and to support the then-necessary rapid vaccine production. As a result, the acceptance of SUSs in different clinical and commercial production processes has increased from an average of ~50 per cent in 2019, to ~70 per cent in 2024.

The trend though, in terms of the selection of the media type has been rather unaffected by the major shifts and Liquid Chromatography (LC) still reigns over Gas Chromatography (GC) by a significant factor. The dominance of LC can be mainly attributed to its compatibility with a wide range of biomolecules and currently, the industry is rapidly adopting more advanced LC techniques like High-Performance Liquid Chromatography (HPLC) and Ultra-High-Performance Liquid Chromatography (UHPLC).

According to reports, the top 5 players in the Biopharma Chromatography Market namely Thermo Fisher Scientific Inc., Shimadzu Corporation, Waters Corporation, Danaher Corporation, and Agilient Technologies Inc., capture >60 per cent of the market, and all of them have a strong portfolio for LC systems. But, as of January 2025, only two of them offer single-use systems.

It should also be noted that three out of the above-mentioned five leading players are US-based and that, combined with the United States’ $180 billion annual healthcare R&D budget, positions the US as the leading player in the Biopharma Chromatography Market.

While the US is expected to maintain its dominance in the market for another decade, if we look at the immediate next five years, not the US or China, but India is expected to be the fastest growing country, according to Stratview Research.

Presence in Indian Market

The demand for biopharma chromatography systems in India will emanate both from domestic as well as international needs. As per the India Brand Equity Foundation (IBEF) India has the largest number of the United States Food and Drug Administration (USFDA)-compliant pharmaceutical plants outside the US and currently supplies over 50 per cent of the global demand for various vaccines, 40 per cent of generic demand in the US, and 25 per cent of all medicine in the UK. This is primarily because of the presence of a skilled workforce, in combination with cheaper operations. Conducting clinical trials in India is anywhere between 40 and 70 per cent cheaper as compared to the US and Europe, and the manufacturing of drugs is also 30-35 per cent cheaper. Thus, India already is one of the most preferred hubs for pharmaceutical process outsourcing, in the West.

Moreover, recent policies like the US Biosecure Act, which was introduced in 2024 and restricts US pharma companies from doing business with certain Chinese companies, will open even newer avenues for the Indian market. Since chromatography systems are critical in both clinical trials as well as drug testing and manufacturing operations, an increase in the number of Contract Manufacturing Organisation (CMO) and Clinical/Contract Research Organisation (CRO) deals with India will drive significant demand for chromatography systems.

Apart from the external demand, there are several factors that will drive the market internally. In the past 5 years, India’s biotechnology R&D expenditure has increased >3x, from ~$300 million in 2020 to $1 billion in 2024 and, the Common Healthcare Expenditure (CHE) as a per cent of GDP has also been increasing consistently for the same period. Additionally, several schemes like the Strengthening of Pharmaceutical Industry (SPI), the BIO-E3 biotechnology policy, and the PRIP (Promotion of Research and Innovation in Pharma MedTech Sector) further strengthen the development of the pharmaceutical industry in India.

The BIO-E3 biotechnology policy announced in 2024 for instance, is the nation’s 1st ever Biotechnology policy and has been given Rs 1000 crore to further accelerate innovations in biotechnology, demanding advanced analytical techniques.

The PRIP scheme, proposed by the Department of Pharmaceuticals in 2024 has a budget outlay of Rs 5000 crore and aims at transforming the Indian pharmaceuticals sector by strengthening the research infrastructure in the country.

The supporting government policies and the increasing number of CRO and CMO contracts from overseas will act as the primary drivers behind India’s strong positioning in the market and according to Stratview Research, India will generate a demand for 1000+ biopharma chromatography systems annually, every year, starting 2028.

Next Step is Integration

The direction in which the industry is headed currently, is the direction of integration, automation, and collaboration. Integrating blocks like mass-spectrometry into chromatography operations helps achieve improved separation of more complex mixtures and not to mention, automating the process leads to an increase in sample throughput and the overall efficiency thus.

AI, just like every other domain, has found application in bioprocessing systems as well. Integrating AI technology in autosamplers allows for streamlined workflow and when combined with cloud-based data management systems, allows better collaboration between researchers and analysts. For instance, in 2024, Waters Corporation announced the launch of the HPLC CONNECT software, which is an all-in-one software platform enabling full digital synchronisation between HPLC/UPLC systems and multi-angle light scattering instruments (MALS) – vital instruments for complex and critical biopharmaceutical processes. The software enables users to control and monitor HPLC modules including pumps, column ovens, UV detectors, and autosamplers from a single dashboard view.

The penetration of AI has seen such a surge that in 2023 alone, combined deals worth $12 billion were announced between life sciences and AI companies, which is worth ~4x the deals announced in 2022.

As AI, automation, and cloud-based solutions become increasingly central, they will not only enhance efficiency but also foster unprecedented levels of collaboration and adaptability. This integration marks the beginning of a new era, where technology and science will converge to address complex challenges and unlock the full potential of biopharmaceutical processes.

Aditya Joshi, Co-Founder and Marketing Head, Stratview Research