2022 will see several quality companies in health sciences getting listed

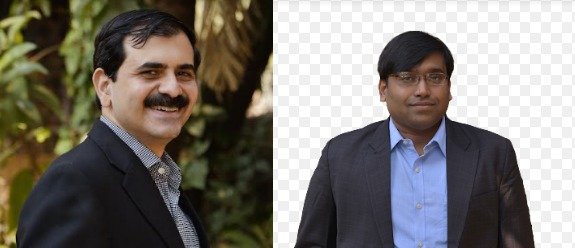

February 06, 2022 | Sunday | Views | By Navroz Mahudawala, Founder, Candle Partners and Ankit Poddar, Director, Candle Partners

Trends in Health sciences in 2021 & Prognosis for 2022

The year 2021 was a mixed bag year for the health sciences sector with substantial fund-raising activity witnessed in the healthtech side & muted activity in the traditional areas of Pharmaceuticals & Healthcare Services. Thanks to COVID-19 in 2020 the earlier year had a built-in expectation from the sector which to some extent did not get fully realised in 2021. We at Candle Partners expect the traditional sectors to come back very strongly in 2022. Below are some of our thoughts on the year gone by (2021) and what we envisage to unfold in 2022

Negligible primary capital in 2021 in traditional sectors; majority of deals were secondary – we expect this trend to change from 2022 onwards

2021 saw limited primary capital infusion by Private Equity Investors in Pharma &Healthcare services Sectors; a second consecutive year of a similar trend. Almost all deals done by PEs this year were secondary in nature. A similar trend was witnessed in the healthcare services (hospital) sector too over the last 2 years wherein limited primary capital has been put.

The maximum primary capital was brought in the health tech space by VCs (early and late stage). 2021 saw emergence of four health-tech unicorns (there were none prior to that) - CureFit (last valuation of $1.56 Bn), Innovaccer (last valuation - $ 3.2 Bn), Pharmeasy (last valuation $ 5.6 Bn pre IPO round) and Pristyn Care (last valuation $ 1.4 Bn)

We see this trend reversing from this year (2022) onwards as several capex expansions are being planned by the Pharma companies especially in the API universe and we will see more primary capital deals. Also, some of the capex done in the hospital space 5-7 years back have now matured and there will be a need for fresh capital which would mainly be driven by PE / IPO capital this year

The API sector has seen a three-fold increase in investments in 2021 compared with a year ago. Three private equity-led investment platforms have been created specifically targeting the API space viz., Hong Kong-based alternative investment firm PAG Asia Capital and its consortium partners CX Partners and Samara Capital; Advent International and the API platform by Carlyle Group. The acquisitions done by these platforms were the key deals in the API sector.

Hospitals stocks were rerated during covid with improving operational performance. Consolidation activity in space also witnessed positive trends with established players acquiring single location hospitals. Some notable deals were CIMS by Marengo, Vikram Hospital by Manipal.

Investment/ Consolidation in E-Pharmacy space in a very early phase; we may see more deals with e-pharmacy players looking at more diagnostic players

2021 was the year of consolidation in e-pharmacy space after certain years of challenges in fund raise amidst the regulatory uncertainty. These included 1) Pharmeasy’s acquisition of Medlife 2) Reliance’s acquisition ofNetmeds 3) Tata’s acquisition of 1Mg 4) Flipkart’s acquisition ofSastaSundar. In an allied deal Pharmaeasy acquired Thyrocare in an effort to create a more holistic primary care healthcare aggregator. We expect similar deals in the next couple of years where select healthtech players would acquire physical world healthcare services players.

MNC Pharma companies continue to rationalise their portfolios or their sites to bring them in line with global therapeutic focus areas; more portfolio shedding can be expected going forward

MNC subsidiary companies in India continued to divest select businesses & assets in order to ensure that their businesses remain lean and more in line with their parent portfolios.

- Sanofi’s divestment of Soframycin and allied products to Encube and their divestment of their nutraceuticals business to Universal group demonstrates an increasing trend of global companies realigning their portfolios in India

- GSK India sold its greenfield Zantac site in Vemgal Karnataka to Hetero ; for which it has spent almost USD 155 million for hardly USD 25 million as part of its efforts to streamline its manufacturing operations

Within healthcare, Diagnostics as a sector had the maximum consolidation in the year

- With 3 large M&A's (Pharmeasy/Thyrocare ,Dr Lal’s / Suburban and Metropolis – Dr. Ganeshan’s Hi-Tech) & select fund raising (Tata Cap / Atulaya Healthcare ,Morgan Stanley / Sterling Accuris, Accel invested in Orange Diagnostics) diagnostics witnessed max action after a long time. While there will be select consolidation opportunities this year, there will be more fund raising as select PEs will continue to back regional players.

- We have seen similar cycles and trends earlier with PE funds backing then regional Pathology players LPL, Metropolis and Thyrocare (2005 to 2007). This cycle repeated between 2011 to 2013 with funds backing Medall, Suburban, SRL, Core Diagnostics, Suraksha, Medgenome. Then between 2015-2017 PE funds backed Vijaya Diagnostics, Apollo, iGenetic, Krsnaa. The difference in this cycle is the level of consolidation activities that were never seen before.

- The competitiveness in the sector has increased significantly, with several Hospital chains focusing on Diagnostics (viz., Manipal, Max Healthcare, Medicover, Sahyadri Hospitals) along with several deep pocket corporate houses investing heavily in Diagnostics (Pathkind by Mankind family, Unipath by Intas family, Lupin Diagnostics, Rivaara Labs by erstwhile Bharat Serums promoters, Neurberg by Dr.Velu. So far , the new age Healthtech platforms have not been able to significantly dent the market. However, we believe the consolidation in last year in e-pharmacy space would in midterm have impact on pricing for established as well neighbourhood labs.

The year 2021 also saw maximum activity in several Pharma ancillary products and services space where M&A opportunities continue to be driven by inbound M&A / larger strategic partners

There were several transactions in the excipients (manufacturing / distribution), nutraceuticals and CRO space & this would continue in this year too.

- Ideal Cures / Colorcon(excipient manufacturing)

- Novozymes acquisition of Synergia Lifesciences (Nutraceuticals CMO)

- Barentz’ acquisition of Gangwal Chemicals (excipient distribution) ; Azelis’ acquisition of S Jhaveri.

- Aragen’s (GVK Bio) acquisition of Intox Pvt Ltd (pre clinical CRO)

- Veeda acquired a controlling stake in Bioneeds

2021 saw several VCs investing in alternate healthcare models; some of which would scale up in the next 1-2 years to interest late stage private equity players too; ABC World Asia’s investment in HCAH (formerly Healthcare at Home) in Jan 2022 is one classic example.

Besides some innovative models in health-tech; we also saw some several business models in the nutraceutical & allied space scaling up & raising growth capital. Oziva in nutraceuticals &Kapiva in Ayurvedic based D2C products space saw interest from several marquee investors and each of them raised around USD 12 million round. Curative wellness (Mindhouse), Diabetes Management (BeatO), Sleep Monitoring (Dozee) were some of the other interesting business models which raised Series A capital. Selectively VCs also put some capital in early-stage drug discovery with Zumutor Biologics and Ahammune Biosciences raising rounds this year.

The health tech space in specific therapies is still a white space and so is alternate medical technologies area. Till date some of these spaces have not managed to attract VC interest as several investors felt that these start-ups would not be able to scale. However, post Covid some of these thesis have changed and we expect substantial pickup in these areas going forward. Over last 2 years, there has been a significant shift in general thought process with healthcare is moving from provider centricapproach to an individual centric care model. Over next few years we believe VC investments in spaces like Healthcare AI / Big Data / Block chain, mental care, virtual care, remote monitoring, chronic care management will increase. Traditionally technology adoption in Healthcare has been slow but with the overall stress and uncertainty of pandemic in traditional healthcare models, technology adoption has significantly improved. We expect this trend to continue

There was traction on select IPOs in healthcare universe in 2021; 2022 has a large pipeline and we will see several quality companies getting listed

Several companies listed in 2021; after a sizeable lull of earlier years. While Medplus and KIMS did extremely well post listing; the performance of Windlas Biotech, Vijaya Diagnostics, Krsnaa Diagnostics and Glenmark Lifesciences was muted and did not live upto investors’ expectations.

Companies which have filed DRHP and which are expected to list in 2022 are from sub-sectors as varied as Hospitals (Medanta, Rainbow, GPT Healthcare,), Pharmaceuticals (Emcure) Nutrition (Hexagon), Pharmacy / Health Aggregators (API Holdings, Wellness Forever), CRO (Veeda), Medical Devices (Sahajanand Medical Technologies) & TPA (Mediassist Healthcare)

(The authors are senior professionals in Candle Partners. While Ankit Poddar (R) is a Director & leads the Healthcare Practice ; Navroz Mahudawala (L) is the founder of the firm)