Healthcare IT attracts $956 million in Q3 of 2014

October 18, 2014 | Saturday | News | By BioSpectrum Bureau

Healthcare IT attracts $956 million in Q3 of 2014

There were 252 investors who participated this quarter including angels, VCs, Private Equity, and corporate VCs. The quarter also included 12 accelerators/incubators

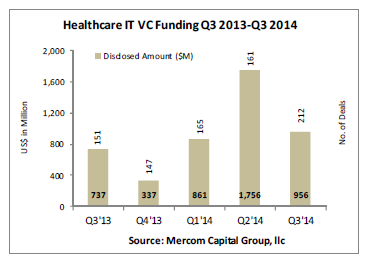

Venture capital (VC) funding in the healthcare information technology came to $956 million, raised in 212 deals globally, a decline of 46 percent in terms of dollars compared to the massive $1.8 billion in 161 deals raised in Q2 2014, a rare quarter. However, Q3 2014 was still the second highest quarter for VC funding since 2010. Total VC funding year-to-date adds up to $3.6 billion. This was revealed in a report on funding and mergers and acquisitions (M&A) activity in the sector for the third quarter of 2014 by the Mercom Capital Group, a global communications and consulting firm. Mercom's comprehensive report covers deals of all sizes in Healthcare IT across the globe.

"Healthcare IT saw another big fundraising quarter in Q3 with almost a billion raised. Companies from countries outside of the United States, accounted for a record 21 percent share of the funding. While consumer-centric companies attracted the majority of the funding this quarter, M&A has been a different story with most (86 percent) of the deals involving practice-focused companies," commented Mr Raj Prabhu, CEO and co-founder of Mercom Capital Group.

Consumer-focused technologies received 65 percent of all VC investments in the third quarter of 2014, with $623 million in 140 deals compared to $678 million in 100 deals in Q2 2014. Areas that received the most funding under this category were Mobile Health with $345 million in 82 deals, followed by Telehealth, which had its best quarter, with $101 million in 16 deals, Personal Health with $85 million in 24 deals, Social Health with $70 million in three deals, and Scheduling, Rating & Shopping with $23 million in 15 deals.

Practice-centric companies received $333 million in 72 deals in the third quarter of 2014, compared to $1.1 billion in 61 deals in Q2. Under this category, the areas that received the most funding were Revenue Cycle Management with $75 million in eight deals, and Data Analytics with $71 million in 19 deals.