Actis to bring down cancer treatment cost

October 07, 2010 | Thursday | News

Mumbai-based Actis Biologics has a

vision to bring to market, high-end technologies and biotechnology

products, at affordable prices. With its star product, 'Angiozyme'

recently entered phase III trials in India, this dream could perhaps

see the light of the day

A successful business plan is an amalgamation of

ideas, passion, putting in place a sound team, getting in the right

investors, funds, and above all, not turning a blind eye to the

failures that might come in the way.

In 2003, when a group of scientists in San Francisco (US) came together

to form Actis Biologics Inc, their sole purpose was to pool in their

patents, research accomplishments, and funds; not just to derive

maximum return on investment, but also to come out with high- end

technologies manufactured at low costs, so that the end product would

reach the consumer at an affordable price. Hence in this case, the

germination of an idea was not enough; but it required a sound business

plan and tactful dealing of logistics. Similarly, setting up its Indian

counterpart, Actis Biologics Private Ltd (ABPL) was no cakewalk for the

founders of the company. Challenges came in the form of limited funds,

limited manpower, finding like-minded partners on board, and procuring

the right technologies.

With the business strategy to be a low-cost manufacturer of products,

without compromising on manufacturing quality products in the field of

biotechnology, today, the company has a host of exciting molecules in

the pipeline, with their 'star product' for colorectal cancer molecule

'Angiozyme' recently entering phase III trials in India. Once

successfully commercialized, Angiozyme is expected to reduce the cost

to treat cancer to one-fifth the conventional costs.

The Genesis

In 2003, a group of biotechnology scientists congregated in San

Francisco with biomedical engineer Sanjeev Saxena, co-founder and

molecular biologist Dr Dave Toman besides other practicing clinicians;

to give expression to Actis Biologics Inc. Recalls Sanjeev Saxena, CEO,

Actis Biologics, “Besides contribution of patents and research

accomplishments, this group of engineers, scientists and doctors, has

contributed their limited funds to build the company, and expand to

other parts of the world. Thus, Actis Biologics Group was formed.�

Within a few years, Actis Biologics Group spread its wings and

established presence in India and Malaysia.

During various visits and interactions with the Government of India,

particularly, the Department of Biotechnology (DBT) and Department of

Science and Technology (DST); it became evident that a market like

India was in dire need of a next generation biotechnology company, that

had lower cost structure besides a diverse gene pool. With the support

of the DBT, Actis Biologics was established in December, 2005; and

valuable patents were transferred to Actis Biologics in India.

Thereafter, Actis Biologics grew with private investments and support

of governmental agencies with schemes such as the Small Business

Innovation Research

Initiative (SBIRI). The company submitted a project titled “Delivery of

MSP36 with Lenti Viral Vector� to the DBT in December 2005, and that

was approved for funding in 2006; with the loan sanctioned in April

2007, and funds dispersed in May 2007.

In May 2007, Actis entered into a strategic tie-up with the Malaysian

government in Melaka, to develop Actis Biocity on the lines of biotech

centers in San Francisco (birth place of biotechnology), San Diego,

Seattle, Boston in the US.

Every business has its set of challenges and obstacles. “We had no

money when we started the company, so the issue was how do we

in-license and acquire technologies? Further, how do we hire the right

people, and motivate them to join and work with us? The other

questions, which we had to deal with, were what technologies to bring

on board, and who all do we want as partners; writing a business plan

and preparing the financial, and then finding the relevant investors,�

reveals Saxena. And then the issue of pricing the company's shares.

Subsequently, after tackling these issues, the funds were raised on a

project basis. Even though their biotechnology molecule for colorectal

cancer, Angiozyme, held a lot more promise, ABPL was unable to work on

further development of this technology, due to limitation on resources.

Further, the management had to contend with a paradigm shift of diverse

molecules in their portfolio.

Business Model

ABPL follows a business model that has already been implemented by many

international companies, wherein, the company will develop and

manufacture products, but market it through experts, who have a large

marketing network. However, what is unique about the marketing strategy

is to spin each technology platform (after incubation phase) as a

separate company; and develop other products using the technology,

besides bringing a partner into that spin off venture.

“As an example, we already did spin out our CAD technology into a

company called Telesto Diagnostics in Malaysia; and are in the process

of looking for appropriate partners, to further develop the company,

and the various products which will be generated, using this

technology,� reveals Saxena.

On the same lines, Actis Biologics has also incorporated under its

banner, Kohinoor Biotech to focus on a ribozyme tech platform; Aum Life

Sciences to focus on development of various recombinant proteins and

mAbs; Mercury Biotech for the development of gene therapy-based

products; and Deep Biotech for development of various immunotherapies,

using a novel cytokine.

Promises of Angiozyme

The company recently made news with its star product, Angiozyme, a

biotechnology molecule targeted at colorectal cancer, entering phase

III trials in India. The phase III clinical studies are expected to

cost the company

233.5

crore ($50 million), a part of which will be funded through soft loans

by the DST, Government of India. The phase III multi-centric trials

will be conducted among 150 patients in select centres in the country.

“The trials are expected to be completed within 18 months from now. The

company is also looking at conducting the trials in locations like

Malaysia, China, Latin America and the US,� confirms Saxena.

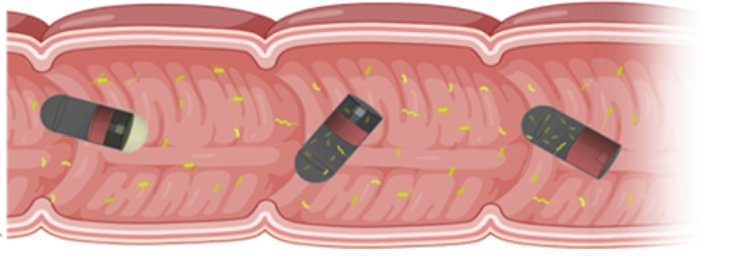

Angiozyme is a unique technology which is a hybrid of RNA and enzyme;

and is, thus termed ribozyme. Since it targets the mRNA, it comes under

the category of antisense. As an antisense catalytic enzyme that

combines with a specific RNA and then cleaves off, it helps in stopping

formation of unwanted blood vessels; thus stops the nutrition from

being supplied to tumor cells, and also starving these unwanted cells.

But, what is important about this technology, is that it works where

ever we need to stop blood vessel formation, be it in obesity, AMD or

as a contraceptive, since Angiozyme is a hammerhead ribozyme. “With

modifications to ribozyme, we should be able to create other signal

blocking mechanisms, or signal enhancement mechanisms to prevent or

fight other diseases. Now, specifically, in the case of colorectal

patients, the team at ABPL believes it should work by eliminating any

side effects, as well as, allowing for subcutaneous injections by

patients themselves. Further, it can be made so inexpensively, that it

should bring down cost of colorectal cancer care,� informs Saxena.

The technology proposal was studied in depth by a team of over 20

scientists from various departments (such as DST, ICMR, DBT, DCGI), and

was found to have a strong potential, due to its anti-angiogenesis

methodology. It was found that the cost of manufacturing this drug in

India, and its method of delivery, provided for drug costs to be

brought down by a factor of 10; and hence made affordable to the

general population. Due to this consideration, DST agreed to fund the

project.

The market size for Angiozyme just for colorectal cancer in India, is

at

1,341

cr ($300 million) and

6,707

cr ($15 billion) on a global basis (Angiozyme can be used for other

indications as well, breast cancer for example). Over

1,564

cr ($350 million) has gone in the development of this molecule. It will

cost another

290.5

cr ($65 million) to develop this molecule of which

223.5

cr ($50 million) has already been raised. This

223.5

cr ($50 million) has been been funded through soft loans from the DST,

Government of India. “We are just starting the process of exploring

potential strategic tie-ups and hence it is too early to discuss the

same,� says Saxena.

Other Developments

This apart, ABPL's Department for Scientific & Industrial Research

(DSIR)-recognized R&D centre is also conducting research of

recombinant proteins, gene therapy and antisense drugs. ABPL also has

over 20 patents around a very promising technology which was reviewed

by the US FDA and given an Orphan drug status. The LIV1 technology is

focused on making existing drugs more effective and less toxic, by

creating a more targeted delivery mechanism.

Looking at the future, growth for the company would come through both

organic and inorganic route. “This means, internally through soft loans

and grants from the governments of India and Malaysia and the National

Institute of Health, USA. We are looking at inorganic growth by raising

another

134.11

cr ($30 million)�, concludes Saxena.

Nayantara Som in Mumbai

A successful business plan is an amalgamation of

ideas, passion, putting in place a sound team, getting in the right

investors, funds, and above all, not turning a blind eye to the

failures that might come in the way.

A successful business plan is an amalgamation of

ideas, passion, putting in place a sound team, getting in the right

investors, funds, and above all, not turning a blind eye to the

failures that might come in the way.  233.5

crore ($50 million), a part of which will be funded through soft loans

by the DST, Government of India. The phase III multi-centric trials

will be conducted among 150 patients in select centres in the country.

“The trials are expected to be completed within 18 months from now. The

company is also looking at conducting the trials in locations like

Malaysia, China, Latin America and the US,� confirms Saxena.

233.5

crore ($50 million), a part of which will be funded through soft loans

by the DST, Government of India. The phase III multi-centric trials

will be conducted among 150 patients in select centres in the country.

“The trials are expected to be completed within 18 months from now. The

company is also looking at conducting the trials in locations like

Malaysia, China, Latin America and the US,� confirms Saxena.