Partnerships, a New Growth Model for Biopharma Firms

July 07, 2005 | Thursday | News

Indian biopharmaceutical companies are dreaming big. To achieve this, they

have taken the route. They are forging partnerships either in R&D, marketing

or in manufacturing.

Biocon Ltd, India's leading biotechnology company is in the

forefront in entering into partnerships with other companies. Others in the game

are Serum Institute of India, Nicholas Piramal India, Panacea Biotec, Avestha

Gengraine Technologies, Indian Immunologicals, Wockhardt, Bharat Biotech

International and Biological E. About 20 partnerships/joint ventures have been

signed between biotechnology and pharmaceutical companies in the last 18 months.

Most the leading Indian biopharmaceutical companies have adopted the partnership

strategy as a growth model. Indian companies have started looking at this

business model for different activities such as R&D, manufacturing, contract

research and marketing.

Biocon has entered into alliances in R&D, marketing and

manufacturing spaces with different companies. It has entered into an alliance

with US-based Bristol-Myers Squibb Company to supply recombinant human insulin

in bulk form for nine years. Biocon has also entered into a research tie-up with

North Carolina's Nobex Corporation to jointly develop oral insulin for the

global and Indian market, as well as a strategic partnership with New York-based

Vaccinex to discover and co-develop at least four therapeutic antibody products.

As part of the deals, Biocon will also make equity investments in Vaccinex and

Nobex.

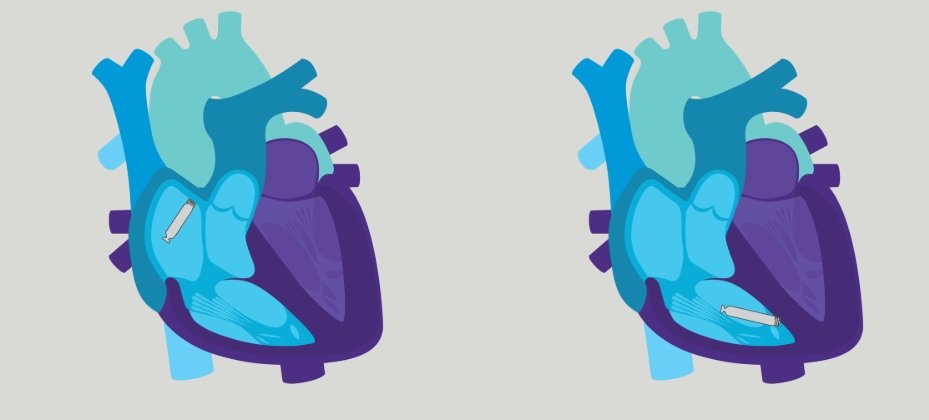

Biocon's subsidiary Syngene International has also entered

into a contract research agreement with the R&D arm of Novartis, the

Novartis Institutes for Biomedical Research Inc. Syngene will conduct research

to support new drug discovery and development, primarily in the early stages,

involving small molecules in oncology and cardiovascular segments.

Serum Institute of India Ltd, a leading manufacturer of

vaccines in India, is another company which is into partnership with an MNC.

Serum Institute has signed an licensing agreement with London-based Lipoxen

Technologies Ltd in a major product development program. The agreement involves

eight new product candidates in total, including protein drugs such as GCSF and

EPO, anti-cancer drugs and vaccines. The Serum Institute provides the active

ingredients and Lipoxen provide the enhanced delivery systems.

The agreement combines Lipoxen's strengths in intellectual

property and innovation in the drug delivery field. Under the agreement Serum

will retain control of marketing in India, Africa, Asia (except Japan) and Latin

America, taking advantage of their existing distribution infrastructure. Lipoxen

retains control of marketing and sub-licensing in the major market territories

and seeks collaboration partners for the marketing of these products in such

territories.

Avestha Gengraine Technologies, a Bangalore-based integrated

biotechnology and bioinformatics company focusing on the convergence between

food, pharma and clinical genomics leading to preventive personalized medicine,

has entered into alliances with companies for R&D and marketing activities.

| The growth models of pharma and

biotech companies

The tepid valuations of many companies on public

markets by venture capitalists may push companies to look at alliances,

mergers and acquisitions as growth models.

With increase in the cost of launching newer drugs and

profit margins being diverted towards R&D activities, alliance,

mergers and acquisition (M&A) have become the norm of pharma and

biotechnology industries. The global trend is big pharma companies are

eyeing biotech companies which are into R&D and developing newer

molecules to enhance their product portfolio.

The significant M&As that happened in 2004 in

global biotech space include acquisition of Tularik by Amgen, the world's

largest biotechnology company, for $1.3 billion. Genzyme acquired

Physician services business of IMPATH for $215 million and ILEX Oncology

for $1 billion. The companies are not limited by geographic boundaries in

their search for strategic partners for growth. A Canadian biotech firm

QLT acquired Atrix Labs for $855 million in stock.

Similarly Icelandic generics major Actavis has acquired

Bangalore-based contract research organization, Lotus Labs in a Euro

20-million all-cash deal. This trend for CRO acquisitions is increasing

and many pharma companies are said to be considering India for such

strategic investments.

The Ahmedabad-based Dishman Pharmaceuticals and

Chemicals has acquired an UK-based contract research company called

Synprotec with an asset base of around £2 million, through its

subsidiary, Dishman Europe. Torrent Pharmaceuticals, again an Ahmedabad-based,

is close to acquiring a German company engaged in generic drugs business

through its German subsidiary. In the recent past, many Indian pharma

companies have acquired European ones. The recent ones include Wockhardt's

acquisition of UK-based generic drugs manufacturer CP Pharmaceuticals for

Rs 83 crore in an all-cash deal; Zydus Cadila's acquisition of the

formulation business of Alpharma of France for a consideration of Euro

5.5m, and more recently, Ranbaxy acquired the French generic drug company

RPG Aventis for around $70 million.

Amalgamations

On the contrary, a few others adopted mergers as a growth model

for their business. In this we find amalgamation of Glenmark Laboratories

and Tasc Pharmaceuticals. The merged new entity would be present both in

the bulk drug and the finished dosage form segments. Even the boards of

Matrix Laboratories and Strides Arcolab, have, in principle agreed to a

merger plan that will take the merged entity into the premier league of Rs

1,000 crore-plus pharmaceutical companies. On completion, the merged

entity - Matrix Strides - would have operations in over 70 countries with

manufacturing operations in India, the US and Latin America. Meanwhile

Matrix Labs has decided to acquire a Belgium-based $263-million pharma

company Docpharma NV.

However, some others continue to look at alliance or

partnership model. Novavax Inc, a specialty biopharmaceutical company has

entered into an agreement with Ranbaxy Labs to evaluate a new transdermal

product. Upon successful completion of the proof of concept study, the

companies expect to enter into a broad commercialization and development

agreement. Abbott India has entered into a fresh distribution agreement

with Novo Nordisk India for the sale and distribution of their insulin

products in India for the period two years as the earlier distribution

agreement with Novo Nordisk had expired by December 31, 2004.

Considering the huge market potential, MNCs are looking

at India to expand their business. Belgium-based Janssen Pharmaceutica,

which has a presence in India through Janssen-Cilag Pharmaceuticals, a

part of Johnson & Johnson (J&J) Ltd, is looking at forging

alliances /partnerships in the area of research and development,

discovery, clinical research and chemical manufacturing.

The prospects for continued growth will depend much on

how successfully these companies adopt these business models, as drivers

behind this trend remain unchanged. |

Avesthagen has entered into a strategic tie-up with two

investors towards furthering its R&D efforts. The company has received a

sizeable amount of investments from two strategic investors including Godrej

Industries Ltd. The strategic partnership is part of its plans of attracting

investments through partnership and the way forward for Avesthagen. It has also

entered into research collaboration with Sequenom Inc., to analyze Sequenom's

proprietary panels of genetic markers associated with diabetes as well as with

breast and lung cancers in Indian patient samples.

The results of this collaboration could provide further

validation of Sequenom's genetic markers and improve the understanding of the

role of these genetic markers in disease onset, progression and therapeutic

response. Avesthagen has announced a strategic joint venture with the

Denmark-based Centre for Clinical & Basic Research (CCBR) and its subsidiary

Nordic Biosciences. Both will work together on a wide array of aspects covering

the diagnosis, treatment and prevention of osteoporosis and osteoarthritis. And

also work together to develop the market in India and worldwide for a

biomarker-based diagnostic kit that significantly improves on existing

technology. It has also entered into research alliance with Cipla to develop

biopharmaceuticals. Under the terms of the agreement, Avesthagen will focus on

research and product development, while Cipla will focus on marketing and

distribution.

In order to strengthen its vaccine portfolio, Hyderabad-based

Biological E has entered into a strategic alliance with the US-based

pharmaceutical major Intercell AG for the development, manufacture and sale of

the latter's Japanese Encephalitis vaccine in Asia. According to the

agreement, Biological E will manufacture the product in India for the Asian

endemic market, while Intercell AG would concentrate to market the product in

the US, Europe and Australia.

Besides biotech-pharma deals we also see a biotech –biotech

deal. One of the major deals is Chiron Vaccines joint venture in India with

Panacea Biotec. This 50:50 joint venture Vaccines Pvt Ltd will focus on

marketing of Hepatitis B and cocktail vaccines in the private markets in India.

Panacea Biotec will look after the institutional sale to UNICEF/WHO.

It has also entered into a collaboration with the UK-based

Cambridge Biostability, for manufacturing vaccines in India using the

"stable liquid technology", which reformulates existing vaccines into

ready-to-inject stable liquids thereby revolutionizing the vaccine delivery

system by eliminating the need of refrigeration for vaccine storage.

Bharat Biotech International Ltd has signed a joint venture

agreement with South Africa's gold and diamond company Mvelaphanda Holdings in

2004 to set up a manufacturing plant for vaccines and generic drugs near

Johannesburg. Under the agreement both Bharat Biotech and Mvelaphanda would have

equal stake. The South African plant would be set up at an investment of Rs

125-150 crore.

Human Biologicals Institute (HBI), a division of the Indian

Immunologicals Ltd, has entered into an alliance with Vins Bioproducts Ltd. This

is mainly for marketing its product called Equine Rabies Immunoglobulin (ERIG),

a drug for animal bite management, under the brand name "AbhayRIG"

through HBI's 2,000-odd "Abhay" clinics spread across the country.

Even Nicholas Piramal India Limited (NPIL), one of the

leading pharmaceutical companies in India focusing on biotechnology, has entered

into agreements with a couple of US-based companies for marketing their biotech

products in India. It has signed an agreement with Gilead Sciences for the

Indian marketing of its biotech drug Ambisome - a treatment for deep-seated

fungal infections. NPIL has also entered into an in-licensing pact with Genzyme

Corporation for marketing Synvisc, a viscose supplement. NPIL has already

entered into a strategic alliance with Biogen Idec, the third largest biotech

company in the world. NPIL's Biotek division is marketing Avonex (Interferon

beta 1a), a leading life-saving therapy for Multiple Sclerosis (MS), in India

and Nepal.

Considering the growth of biotechnology products in the third

world countries Wockhardt with three indigenously developed biotechnology

products has formed majority joint venture in Mexico and South Africa. Wockhardt

has signed a joint venture agreement with Representaciones E Investigaciones

Medicas, SA de CV, one of Mexico's leading national companies. Wockhardt

Mexico SA de CV, 51 percent owned by Wockhardt, will initially market all forms

of insulins manufactured by Wockhardt.

At a later stage, it will market other diabetology products

and biopharmaceutical products. Wockhardt South Africa Pty Ltd, a 51:49 joint

venture between Wockhardt and Pharma Dynamics, will use the regulatory, sales

and marketing expertise of Pharma Dynamics to commercialize the growing

pharmaceutical and biopharmaceutical portfolio of Wockhardt.

These are some of the partnerships that the top Indian

biopharmaceutical companies have entered into to take the lead in the growing

biotechnology industry that has registered a growth of 36.55 percent in 2004-05.

Growth a driver for alliances

The high growth of the biotech industry over the pharma growth is pushing

for more alliances and tie-ups between pharmaceutical and biotechnology

companies in India. Many entrants into biotechnology via tie-ups for marketing

in India continue to focus on alliances. Companies like Glenmark Laboratories,

Claris Life sciences and Emcure Pharmaceuticals are looking for alliances and

seeking permission from the Genetic Engineering Approval Committee (GEAC) for

import and marketing of biotech products in India.

Glenmark Laboratories, which is into marketing of recombinant

biotech products is eyeing the import of r-hu-Epidermal Growth factor for

manufacturing in India a fixed dose combination of 10 ug/GM and Silver

Suphdiazin 1% as a Cream for Topical in burn cases from GGE and Biotechnology,

Cuba. Similarly Ahmedabad-based Claris Life Sciences is seeking GEAC's

permission for import and marketing of r-Human G-CSF, 300mcg in prefilled

syringes in finished form from North China Pharmaceuticals (NCPC) Genetech

Biotechnology Co, Ltd. China. Pune-based Emcure Pharmaceutical which entered the

biotechnology sector with the import and marketing of Erythropoietin developed

by a Chinese company Dragon Pharmaceuticals, is now seeking permission for

import and marketing of r-human Granulocyte Macrophage Colony stimulating factor

in (GM – CSF) from Shenghai Hygene Biopharma Company Ltd. China.

Unlike the global scenario in biosuppliers where we find more

of acquisitions by the leading players consolidating their positions, in

biotechnology industry the trend is towards alliance and partnerships. This is

because most of the biotech companies are privately owned and spend their

resources on highly focused and innovative biotechnology-based research. These

cash constraint firms look for financial support mainly from VCs. Though biotech

is one of the fields VCs are eyeing, they not eager to invest at this point of

time in the biotechnology industry. The only alternative left for these upcoming

biotechnology companies is joining hands with big pharma/ biotech companies.

As rightly pointed out by Ernst & Young in its

"Beyond Borders 2005", for biotechnology companies, partnership is an

important means of mitigating risk as well as a strategic response to business

challenges. Since drug development is an inherently high-risk business,

characterized by large R&D investments and relatively small probabilities of

success, partnerships will always be an important factor in diversifying and

mitigating risk. It is also one of the ways of entering newer potential markets.

Big pharma companies and some of the leading biotech

companies are looking for ways to expand their product pipelines and identify

promising targets and products. For many smaller biotech companies, raising

capital is an overriding concern. This motivates them to enter into alliances to

generate revenues or to accelerate their path to products, as investors in both

the public and private markets demonstrate a strong preference for companies

with products or late-stage pipelines.

On the other hand, leading companies are entering into joint

ventures with local firms to market their range of products. Based on the

present scenario, the year 2005 will see more partnerships provided the

companies get support from the government by enforcement of the product patent.

| Some

of the partnerships signed in the last 18 months |

| Companies |

Collaboration |

| Biocon |

Bristol-Myers

Squibb |

Supply |

| Biocon |

Nobex

Corporation |

R&D |

| Biocon |

Vaccinex |

R&D |

| Syngene International |

Novartis

Institutes for Biomedical Research Inc |

Contract

research |

| Serum Institute of India |

Lipoxen Technologies |

Product

development |

| Human Biologicals Institute |

Vins Bioproducts |

Marketing |

| Biological E |

Intercell AG |

R&D,

manufacture and marketing |

| Panacea Biotec |

Chiron Vaccines |

Marketing |

| Panacea Biotec |

Cambridge Biostability |

Manufacturing |

| Nicholas Piramal |

Gilead Sciences |

Marketing |

| Nicholas Piramal |

Genzyme Corporation |

Marketing |

| Avestha Gengraine Technologies |

Godrej Industries |

Attracting

investments |

| Avesthagen |

Sequenom Inc |

R&D |

| Avesthagen |

CCBR and its subsidiary Nordic

Biosciences |

R&D |

| Avesthagen |

Cipla |

R&D |

| Bharat Biotech International |

Mvelaphanda

Holdings |

Setting up manufacturing

facility |

| Wockhardt |

Representaciones E

Investigaciones Medicas |

Marketing |

| Wockhardt |

Pharma Dynamics |

Marketing |

Narayan Kulkarni