India’s orthopaedic and cardiac implant sector to touch $5 B by FY28: Report

May 21, 2025 | Wednesday | News

Homegrown companies are gaining share and expanding in the export market

image credit- shutterstock

According to CareEdge Ratings, India’s orthopaedic and cardiac implant sector, including exports, which stood at ~$2.4 to $2.7 billion in FY24, is expected to reach ~$4.5 to $5 billion by FY28, driven by strong domestic demand and gradually growing export presence.

Foreign MNCs, with their long track record of safety and efficacy, have built trust among medical practitioners, which has led to their dominance in the Indian market. However, Indian implant manufacturers are making rapid strides in the domestic market and are gradually expanding their presence in the export market.

CareEdge Ratings cited that with only 7.5% customs duty on the import of most coronary and orthopaedic implant products, any potential trade deal with the US resulting in tariff reduction is not likely to materially change the market dynamics for domestic manufacturers.

However, material changes in non-tariff barriers, such as the relaxation of price caps, can significantly alter the competitive landscape for domestic manufacturers compared to MNCs.

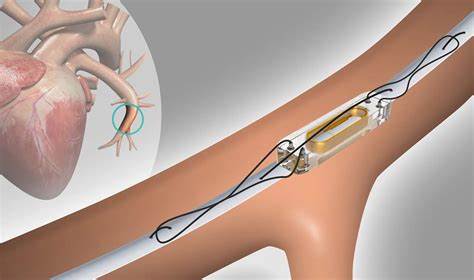

The prices of knee implants are capped at approximately ~Rs 32,000 to ~ Rs 83,000, depending on the type and material used. Drug-eluting stents are capped at ~Rs 38,000, while bare metal stents have a ceiling price of ~Rs 10,500.