Biopsy Device Market to expand at CAGR of 6.5% by 2026

August 05, 2019 | Monday | News

Key players focussing on strategic M&A for amplified market shares

Patients increasingly prefer minimally invasive surgical procedures in order to avoid conventional surgical complications and side-effects, promoting sales of biopsy devices, leading to the growth of the biopsy devices globally. In addition to enabling the accurate diagnosis, a biopsy device assures minimal patient discomfort and trauma. This is identified to be a major factor impacting the popularity of biopsy, and biopsy device thereby.

Over the 10-year forecast period 2016-2026, the global biopsy device market is estimated to witness a moderate yet promising CAGR of 6.5%, according to Future Market Insights. In a recently published report titled “Global Biopsy Device Market: Global Industry Analysis and Opportunity Assessment, 2016–2026”, Future Market Insights analyses the market for biopsy device and offers key insights into the market condition for the aforementioned period. Valued at around US$ 1,397 Mn in 2016, the market will possibly attain the revenues beyond US$ 2,621 Mn by 2026-end.

Key Opportunities for Manufacturers and Suppliers, Grasped by Future Market Insights Research:

- Developing economies present lucrative, untapped markets for biopsy device.

- Growing adoption of hybrid imaging technology will underpin new growth opportunities.

- Following massive consumption by hospitals, demand for biopsy device from specific oncology centres and research institutes will prompt at multiple opportunities in near future.

- Surging demand for minimal invasive breast biopsy highlight lucrative opportunities that lie in the breast cancer sector.

- Increasing adoption of biopsy device by oncologists will generate several revenue generation opportunities in the disease monitoring sector.

Supported by increasing discretionary funding for cancer research, growing government expenditure for healthcare and favourable reimbursement scenario (especially in the U.S.) will collectively elevate the revenue sales of the global biopsy device market. Collaborations between various government and private companies, fuelled by increasing awareness about disease diagnosis and monitoring, will further elevate the market growth in near future.

M&A and Technological Upgrades Remain at the Forefront

A majority of key players in the global biopsy device market are currently focusing on providing innovative biopsy tests and technological upgrades. Mergers, acquisitions, and partnerships with diagnostic laboratories will help to strengthen their presence in the global market.

Among the top companies, Becton, Dickinson and Company is concentrating on innovative, cost-effective product development, whereas Hologic, Inc. is targeting manufacture and sales of biopsy devices, especially for breast cancer surgeries. Other notable players include Boston Scientific Inc., C. R. Bard, Inc., B. Braun Melsungen AG, Cook Medical, INRAD Inc., and PLANMED OY.

Argon Medical, one of the promising new entrants, is expanding its product portfolio and collaborating with established players, whereas for Devicor Medical Products Inc., M&A remains the key strategy.

North America Retains the Most Lucrative Market, Developing Countries to Witness Impressive Growth over 2016-2026

North America will remain the dominant market, reaching nearly US$ 882 Mn by 2026 end, accounting for over 33% share of the market. Western Europe is expected to remain the second largest market for biopsy device, crossing a value of US$ 683 Mn by the end of 2026, capturing over 26% share of the market.

APEJ, with around 14% market value share in 2026, is likely to reach US$ 370.0 Mn by the end of forecast period. MEA will register the fastest CAGR of 7.3%, followed by APEJ and Latin America with the respective CAGRs of 7.1% and 6.5% over 2016-2026. North America, Europe, and Japan will see moderate growth over the forecast period.

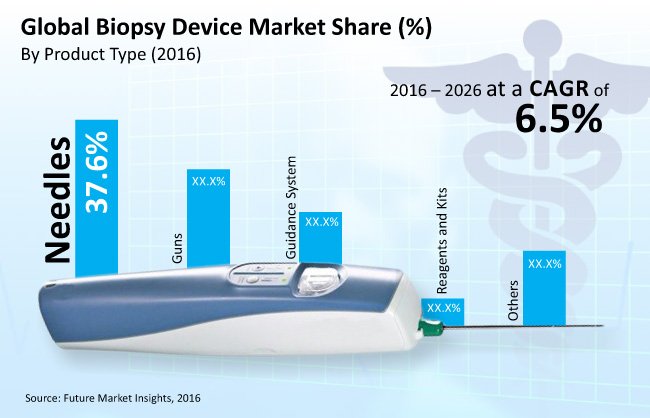

Needles Continue to Drive Product Type Segment

By product type, needles will remain dominant with over 36% share of the market value in 2026, whereas guns will represent the second largest sub-segment with over 26% market value share in 2026. With growing significance of early diagnosis of breast biopsy, guidance system segment is estimated to gain around 222 BPS in its market share by 2026 over 2016. Stereostatic X-ray guided biopsy will drive the guidance system segment through to 2026. Reagents and kits will witness moderate consumption.

Medical Diagnostics Monopolise Application Segment

Based on application type, medical diagnostics will continue to hold a dominant share of over 61% by 2026 end, in terms of revenues. Scientific research, accounting for the rest, will witness an impressively growing CAGR of 6.9% over 2016-2026. This segment is expected to reach beyond US$ 1,008.0 Mn in 2026.

Hospitals Remain Largest End-use Consumer

By end-user, hospitals will continue to contribute nearly 50% share to the market value by 2026 end. This end-use segment will witness a robust CAGR of 8.2%. Diagnostic centres will account for over 23% in 2026 with a slight decline over 2016-2026, whereas specialised oncology centres are anticipated to expand at a CAGR of 6.1% during 2016-2026.