Strengthening biotech clusters with PPPs would spur growth

April 16, 2018 | Monday | Interviews

Changes in the rapidly evolving Life Sciences industry have driven the demand for highly niche, boutique Life Sciences services, which TAKE is well-positioned to deliver to its global client base.

Life Sciences executives are realizing that supply-chain improvement can not only lead to significant increases in shareholder value, but it can provide competitive advantage in sales channels and accelerate the launch of new products through to profit.

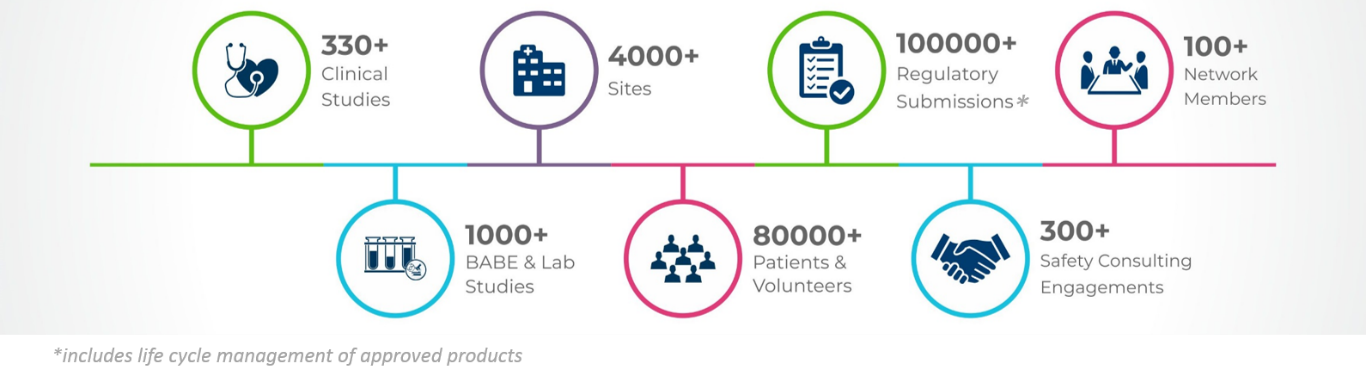

In the fast-growing Life Sciences space, TAKE offers clients a unique combination of a full-service CRO backed by industry insights and technology expertise. Our range of services span from clinical trials to regulatory submissions to post-marketing safety, all backed by insights derived through our proprietary industry networks. With a team of leading Life Sciences experts, best-in-class systems and processes, and bespoke, industry-specific technology and analytics, TAKE delivers outcomes for clients, including 9 of the top 10 global pharmaceutical companies.

The company is now taking significant strides towards emerging as a larger organization by 2021. BioSpectrum recently interacted with Ram Yeleswarapu, President & CEO, TAKE Solutions, to find out more about the expertise TAKE offers across Life Sciences and Supply Chain Management.

What are the major plans up ahead for TAKE solutions? Are you planning any collaborations or acquisitions to strengthen your position further in the market?

We are extremely excited at the opportunities ahead of us. With a number of clinical trials being designed across various indications and the investment capital being committed to a growing pipeline of biosimilars, we believe we have the subject matter expertise and appropriate technology platforms to execute these efficiently and in full compliance with ICH E6 R(2). We will continue to grow our business in the Clinical, Regulatory, PV, and Generics spaces while providing process consulting and technology expertise across numerous functional blocks in the pharmaceutical and biotechnology value chain. We are quite open to exploring collaborations including strategic tie-ups, especially where we see complementary strengths and where we believe that am organic build will take an extended period of time.

What are your views on the current scenario of clinical trials in India? How can the situation be improved?

In recent years, CDSCO has brought regulatory reformation for conducting clinical trials in India ensuring patient safety, development of innovative and affordable medicines. There have been many positive efforts to enhance stability and transparency in the regulatory process including thorough scientific review of CT applications by relevant subject experts (SEC), online CT applications, reduced CT approval timelines, etc. We sincerely believe that all these bode well for the industry and ultimately for the patient, especially when it comes to affordability of life saving medicines.

A few examples of regulatory reforms in India:

- Revised guidelines permit to pay compensation only up to the point that the drug caused an adverse reaction in a patient who participates in the trial.

- Audio-visual recording of informed consent is not a must in every case.

- A new circular released by CDSCO has also removed restrictions that stopped investigators to conduct more than 3 clinical trials at a given time period. The regulatory body (DCGI) has put the responsibility on the Ethics Committee to take into consideration the complexity and nature of the clinical trials and grant permission in accordance.

- DCGI has also revised the compulsory requirement that clinical trials can be done at the sites that have over 50 hospital beds. The Ethics Committee can now decide whether the trial site is suitable or not. It is compulsory that the site has an emergency medical care and rescue arrangements which is essential for a clinical trial.

- Clarity in Compensation guidelines.

- AV consenting limited to vulnerable population in NCE and NME.

- Removed restrictions on the number of trials for an investigator and beds at the site and empowered the Ethics committees to take the decision.

In addition to these regulatory reforms, availability of a large patient pool, experienced Investigators, site team, infrastructure, CROs and huge market opportunities will make India a favorable country and be a part of the global clinical development of investigational products for pharmaceutical and biotechnology companies.

Though India has a large population, lack of access or awareness of ongoing clinical trials is limiting adequate patient participation, especially with diseases having no or limited treatment options. Navitas Life Sciences is developing innovative methodologies to enhance visibility and collaboration with patients and health organizations to more efficiently conduct clinical trials ensuring patient safety and data integrity.

Indian pharma companies are demonstrating their capability to develop biosimilar for global healthcare markets. What more should be done to make India a dominant player in the field of innovative medicines?

We believe that sound infrastructure coupled with a robust legal and regulatory framework and respect for intellectual property rights will allow the investment climate in India to spike significantly. A scalable and sustainable channel of skilled and trained manpower would be critical to ensure that we have adequate head room for growth and expansion in the biosimilars industry. While the framework needs to be thought through carefully and adjusted according to indigenous needs and priorities, the administrative burden needs to be simplified. Strengthening of R&D centers and biotechnology clusters and a strong encouragement for public-private partnerships would spur innovation and growth. At the same time, given the significant socio-economic disparity in our society, affordability of life saving medicines becomes crucial and from giving tax incentives and breaks, to grants and loans to the industry, a number of moves will have to be orchestrated simultaneously. Health data cooperatives could be an answer to ensuring healthcare data acquisition and effectively channeling the use of that data with appropriate incentives to individual participants.

What is your take on the enhancement of precision medicine and telemedicine in India?

- Policies/Guidelines for precision medicine for various applicable therapeutic areas

- Developing capacity and infrastructure - Hospitals etc.

- Setting up cost-effective, high quality and accessible Genomic Labs across India along with analytics and logistics partners

- Public patient Biobanks/Genomic Databases

- More robust collection of real world evidence

- Public-Private partnerships

How do you foresee the impact of SMAC and Big Data on the life science and healthcare industry in India in the coming years?

Mobile platform and secure cloud based storage and access of data make R&D ubiquitous. In today’s age this is critical, given that we cannot afford to operate in a silo environment and not have safe, effective, and affordable medicines extended to world population. At the same time, applied correctly and judiciously, data analytics and data sciences are fundamental to decision making and prioritization of efforts. For India, given the significant catch up we have to do with the developed world, crossing the chasm of infrastructure by leveraging SMAC technologies and Data Sciences is extremely appropriate. However, a fundamental shift to digital is mandatory along with an acceptance that transparency, quality, and integrity of data is paramount for any success. This would be a precursor to any advancements.