West Pharma bets big on Crystal Zenith

May 16, 2015 | Saturday | Features | By BioSpectrum Bureau

West Pharma bets big on Crystal Zenith

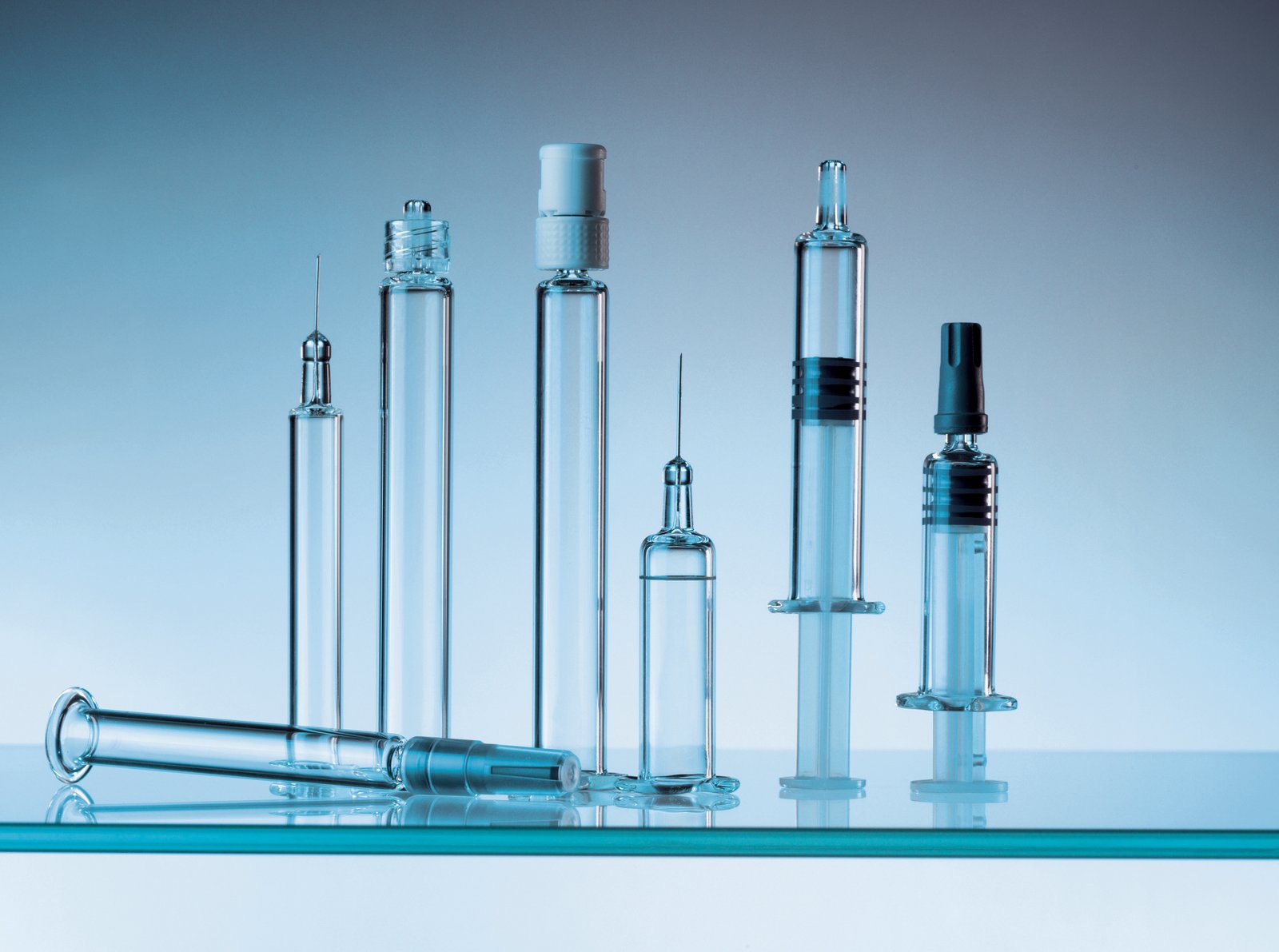

(Photo Courtesy: www.schott.com)

In April, West Pharmaceuticals, a manufacturer of drug administration systems and components, held several seminars across Indian cities to discuss its exclusive product -- Daikyo Crystal Zenith (CZ), which it claims will be the new life cycle solution for drug containment in the pharma industry, seen as an alternative to traditional glass.

Crystal Zenith components are made of Cyclic Olefin Polymer (CoP) material, which is said to be more inert than glass.

West said that this new containment solution will address issues of breakage, protein aggregation, delamination, and reactions with tungsten or silica, usually associated with glass.

R&D impact

Glass recalls were maximum in 2011, followed by 2014. Glass recalls have maximum impact on R&D plans affecting companies' competitive advantage. Consequently, the company experiences major revenue loss, impacting patient-access thereby promoting negative corporate image.

West claims that the world's 35 biologics are packaged and delivered with components manufactured by West, and its Japanese partner, Daikyo Seiko. Their partnership has been in existence since 1970.

According to the company, the CZ product is manufactured at West's US plant in Scottsdale, Arizona, and Daikyo's plant in Japan.

Currently, CZ is unavailable in India. "We are working with customers to get into stability trials and test the product. We see Indian market to be lucrative and rapidly growing in the APAC for this product. Now we are on a level of talking to customers about the alternatives to glass and its benefits," said Mr Kevin D Cancelliere, director of marketing, pharmaceutical delivery systems, West Pharmaceuticals.

Targeting expensive drugs

Mr Cancelliere said that the company at the moment is targeting expensive drug products that are still in the pipeline.

The CZ's target markets include Australia, China, India, Japan, Singapore, and Taiwan.

Initially the company seeks to get a handful of customers to start the initial phase of evaluation. "So far, 6 to 8 customers have expressed interest in the product," he revealed.

"This product may take at least two more years for its launch," Mr Cancelliere added.

Pricing

Mr Cancelliere sees a major challenge for CZ in the Indian market - pricing. "The price is going to be a challenge. We are selling products of higher costs but it is a premium offering. The features outweigh the costs. This product is exclusive, and there are no other similar products. It is silicone-free and a first-in-class new polymer," he opined.

"In terms of product volume, we want to produce about 2-3 million of it annually," he further said

He also hinted that West Pharma will possibly have new acquisitions in the future which would further add to its capabilities.

The market

West's main line of business include pharmaceutical packaging systems, and pharmaceutical delivery systems, which recorded revenues touching $1 billion and $402 million in 2014 respectively.

Globally, sales of self-injection devices touched $181 billion in 2014. Out of which, 44 percent was for self-administration devices ($80 billion) and 56 percent for physician-administered devices ($101 billion).

Experts believe that increased regulatory scrutiny, and higher focus on quality risk management calls for containment materials which do not interfere with the drug or hamper its effectiveness.

Patent expirations

He pointed that the number of biologics are reaching their patent life. "We see tremendous growth in the area of biosimilars. Biosimilars are going to explode, and CZ is going to be a game changer. We are going to have generics come out and have lower cost alternative. Some of the existing biosimilars where glass is used have packaging issues, and CZ will address that," he held.

Speaking about the market share, Mr Cancelliere commented, "We have certain projections, and for injectables, globally, we hope to capture 5 percent market share by 2019. A small portion of this will come from APAC, which could be less than a percent."