Is Indian pharma ready to tap the European market?

July 19, 2017 | Wednesday | Features

Indian drug companies are facing strong headwinds due to prompt regulatory action of United States Food and Drug Administration (USFDA), likely imposition of Border Adjustment Tax (BAT) and delay in new drug approvals. Probably, it is the best time for Indian pharma companies to explore opportunities and business in the European market.

According to the European Health Report 2015 issued by the World Health Organization (WHO), alcohol consumption, tobacco use and obesity are among the major public health problems in the European Region. But cardiovascular diseases and cancer are the leading causes of premature mortality. In 1998, cancer accounted for just over one third (37 per cent) of premature mortality, and this rose consistently to 43 per cent in 2012.

According to WHO report, with more than 3.7 million new cases and 1.9 million deaths each year, cancer represents the second most important cause of death and morbidity in Europe. On a global scale, cancer accounted for 8.2 million deaths (around 13 per cent of the total) in 2012.Tobacco consumption and excessive alcohol consumption cause about 40 per cent of the total cancer burden. The precise figures vary from country to country.

The report further notes that if the consequences of inappropriate diet, obesity and insufficient physical activity are added, the percentage of cancers due to an unhealthy lifestyle rises to 60 per cent. Although more than 40 per cent of cancer deaths can be prevented, cancer accounts for 20 per cent of deaths in the European Region. Europe comprises only one eighth of the total world population but has around one quarter of the global total of cancer cases with some 3.7 million new patients per year. Lung, breast, stomach, liver, colon and breast cancer cause the most cancer deaths each year.

Global cancer drugs market

According to Zion Market Research, the global demand for cancer drugs market was valued at approximately $ 112.90 billion in 2015 and is expected to generate revenue of around $ 161.30 billion by end of 2021, growing at a CAGR of around 7.4 per cent between 2016 and 2021.

However, Mordor Intelligence market report, the global cancer therapy market is estimated to grow at 17.6 per cent CAGR to reach $52.2billion by 2021. Breast cancer therapy is the largest market expected to reach $30.8 billion by 2016 at an estimated CAGR of 15 per cent.

According to cancerconvention.com the global cancer diagnostics market is expected to reach $13.1 billion in 2020 from an estimated $7.1 billion in 2015, growing at a CAGR of 12.9 per cent. The market is dominated by North America, followed by Europe, Asia, and Rest of the World (RoW). The cancer diagnostics market in Asia is expected to grow at the highest rate from 2015 to 2020.

Zion report states that the global cancer drugs market is primarily driven by growing incidences of target disease such as lung cancer, breast cancer, cervical cancer, etc. across the globe. Other major driving factors are increasing research and development on biological and targeted drug therapies for the treatment of cancer coupled along with the expiration of patents. However, the high price of drug development and stringent regulatory policies coupled along with the possibility of failure are the major restraints that may limit the growth of the market. Nonetheless increasing focus on personalized medicine coupled along with huge investment in anti-cancer drugs research across the globe is likely to disclose the new avenues for cancer drugs market in the near future.

The cancer drugs market is segmented on the basis of the different therapeutic segment including immunotherapy, targeted therapy, chemotherapy, hormone therapy and others. Immunotherapy segment is expected to grow at fastest rate in the global market over the forecast period.

Breast cancer, blood cancer, gastrointestinal cancer, prostate cancer, skin cancer, lung cancer and others are the key cancer types of the global cancer drugs market. The blood cancer segment dominated the market in terms of revenue.

North America represents developed regional markets for cancer drugs and is expected to see the rapid growth in the years to come. The US is by far the leading cancer drugs market by country in North America. The US market is expected to grow at the highest CAGR during the forecast period. This growth is mainly due to the well-developed healthcare infrastructure and the increase in research and development on cancer drugs. Moreover, the disposable income and reimbursement of life-threatening diseases are very high in this region which promotes the growth of cancer drugs market.

Europe was the second largest regional market and is expected to show significant growth in the years to come. This growth is mainly due to increase in a number of patients diagnosed with cancer. Asia-Pacific is expected to witness noticeable growth in the near future. In Asia, China, India, and Japan will continue to be the fastest growing markets in cancer drugs market. Growth in Asia-Pacific market is expected to be driven by increasing tobacco consumption, growing population, and increasing disposable income.

Some of the key players in cancer drugs market include Bayer, GlaxoSmithKline, Novartis, Sanofi and Pfizer, Amgen, Merck, Bristol-Myers Squibb, Celgene Corporation, Ariad Pharmaceuticals, Eli Lilly, Hoffmann-La Roche Ltd, Boehringer Ingelheim GmbH, Johnson and Johnson and Teva Pharmaceuticals among others.

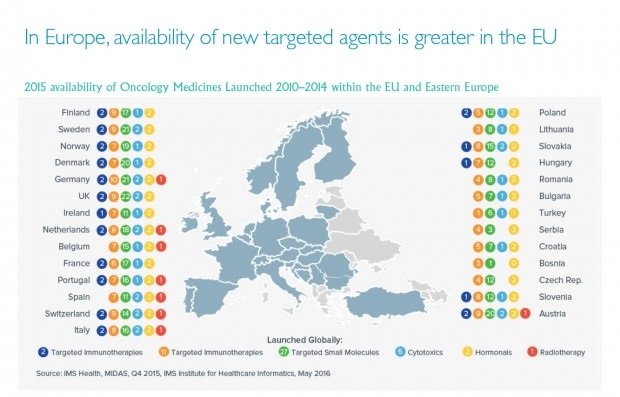

Global oncology trend report by IMS states that from 2012 to 2016, 49 new oncology medicines have been launched, but these new options are not available uniformly in all countries. The United States has access to the most, a total of 41. In Europe, Germany is on the top of the list with 38, followed by the United Kingdom with 37, then Italy (31) and France (28). Oncology drugs are also more widely available in Western European countries than their counterparts in Eastern Europe.

Cancer medicines available in Europe

|

S No

|

Medicine name

|

Common name

|

Marketing Authorisation Holder

|

Status

|

|

1

|

Abseamed

|

epoetin alfa

|

Medice Arzneimittel Pütter GmbH & Co. KG

|

Authorised

|

|

2

|

Akynzeo

|

netupitant/ palonosetron

|

Helsinn Birex Pharmaceuticals Ltd

|

Authorised

|

|

3

|

Aloxi

|

palonosetron

|

Helsinn Birex Pharmaceuticals Ltd.

|

Authorised

|

|

4

|

Aranesp

|

darbepoetin alfa

|

Amgen Europe B.V.

|

Authorised

|

|

5

|

Biograstim

|

filgrastim

|

AbZ-Pharma GmbH

|

Withdrawn

|

|

6

|

Biopoin

|

epoetin theta

|

Teva GmbH

|

Authorised

|

|

7

|

Destara

|

ibandronic acid

|

Roche Registration Ltd.

|

Withdrawn

|

|

8

|

Effentora

|

fentanyl

|

Teva B.V.

|

Authorised

|

|

9

|

Emend

|

aprepitant

|

Merck Sharp & Dohme Ltd.

|

Authorised

|

|

10

|

Epoetin Alfa Hexal

|

epoetin alfa

|

Hexal AG

|

Authorised

|

|

11

|

Eporatio

|

epoetin theta

|

ratiopharm GmbH

|

Authorised

|

|

12

|

Filgrastim Hexal

|

filgrastim

|

Hexal AG

|

Authorised

|

|

13

|

Filgrastim ratiopharm

|

filgrastim

|

Ratiopharm GmbH

|

Withdrawn

|

|

14

|

Instanyl

|

fentanyl

|

Takeda Pharma A/S

|

Authorised

|

|

15

|

Ivemend

|

fosaprepitant

|

Merck Sharp & Dohme Ltd

|

Authorised

|

|

16

|

NeoRecormon

|

epoetin beta

|

Roche Registration Limited

|

Authorised

|

|

17

|

Nespo

|

darbepoetin alfa

|

Dompé Biotec S.p.A.

|

Withdrawn

|

|

18

|

Neulasta

|

pegfilgrastim

|

Amgen Europe B.V.

|

Authorised

|

|

19

|

Neupopeg

|

pegfilgrastim

|

Dompé Biotec S.p.A.

|

Withdrawn

|

|

20

|

Nivestim

|

filgrastim

|

Hospira UK Ltd

|

Authorised

|

|

21

|

Palonosetron Accord

|

palonosetron

|

Accord Healthcare Ltd

|

Authorised

|

|

22

|

Palonosetron Hospira

|

palonosetron

|

Hospira UK Limited

|

Authorised

|

|

23

|

PecFent

|

fentanyl

|

Archimedes Development Ltd

|

Authorised

|

|

24

|

Quadramet

|

samarium [153Sm] lexidronam pentasodium

|

CIS bio international

|

Authorised

|

|

25

|

Ratiograstim

|

filgrastim

|

Ratiopharm GmbH

|

Authorised

|

|

26

|

Removab

|

catumaxomab

|

Neovii Biotech GmbH

|

Withdrawn

|

|

27

|

Retacrit

|

epoetin zeta

|

Hospira UK Limited

|

Authorised

|

|

28

|

Sancuso

|

granisetron

|

Kyowa Kirin Limited

|

Authorised

|

|

29

|

Silapo

|

epoetin zeta

|

Stada Arzneimittel AG

|

Authorised

|

|

30

|

Tevagrastim

|

filgrastim

|

Teva GmbH

|

Authorised

|

|

31

|

Varuby

|

rolapitant

|

Tesaro UK Limited

|

Authorised

|

|

32

|

Zarzio

|

filgrastim

|

Sandoz GmbH

|

Authorised

|

|

33

|

Zoledronic Acid Accord

|

zoledronic acid

|

Accord Healthcare Limited

|

Authorised

|

|

34

|

Zoledronic acid medac

|

zoledronic acid

|

medac Gesellschaft für klinische Spezialpräparate mbH

|

Authorised

|

|

35

|

Zoledronic acid Teva

|

zoledronic acid

|

Teva B.V.

|

Authorised

|

|

36

|

Zometa

|

zoledronic acid

|

Novartis Europharm Limited

|

Authorised

|

Source: http://www.ema.europa.eu/

Many European countries currently face shortages of inexpensive, essential medicines that are crucial for the treatment of cancer patients. Considering that the second most commonly reported medicines shortages are in cancer, a disease with a growing prevalence, this challenge presents an increasing threat to patient care in Europe.

The causes for medicines shortages are complex and multifactorial. A 2016 report by the FDA identified the following reasons for these shortages: (1) Quality: manufacturing issues – 37 per cent, (2) Quality: delays/capacity – 27 per cent, (3) Raw materials – 27 per cent, (4) Increased demand – 5 per cent, (5) Discontinuation – 2 per cent, (6) Loss of manufacturing site – 2 per cent.

Oncology- A booming business

According to the global oncology trend report by IMS 2016, a large and diverse set of more than 500 companies are currently actively pursuing oncology drug development around the world. Collectively they are pursuing almost 600 indications, most commonly for non-small cell lung cancer, breast, prostate, ovarian and colorectal cancers.

The ten largest oncology companies – measured by their current sales of existing cancer drugs – collectively have 130 molecules in their late stage pipelines. This represents from 20 per cent to 60 per cent of their total research activity.

The pharmaceutical industry's 20 top-selling cancer drugs generate sales over $50 billion worldwide. Roche's Rituxan, Avastin, and Herceptin take the lead, with $21 billion in sales for these three drugs alone. There is an increasing demand worldwide for oncology medications, so pharmaceutical companies are seeing significant growth outside of their usual markets.

According to The Wire, India is the fourth largest supplier of pharma to the US, with exports worth $5.1 billion. The UK is the second largest market for Indian pharma exports, which stood at $464 million in 2016. India also exported to other developed markets in 2016, including Australia ($220 million), Germany ($161 million), France ($145 million), Netherlands ($143 million), Canada ($143 million) and Belgium ($125 million).

India’s large pharmaceutical firms have been working towards having enough cancer-fighting drugs in their product pipeline, reflecting a global trend. Some of the firms have expanded their existing oncology divisions, while others have made fresh strategic investments.

Top drug maker Sun Pharma has acquired skin cancer drug Odomzo from Swiss drug giant Novartis for $175 million (around Rs 1,172 crore) as it looks to grow its specialty drug portfolio. On the other hand, Dr. Reddy’s Laboratories Ltd has recently announced expansion of its commercial operations in Europe with the introduction of its portfolio of generics in France. The first products will be made available in the hospital market in the area of oncology and anti-infectives, including antimycotics. On the same league considering the high occurrences of cancer in the country, Zydus has been building a product pipeline to realize its vision of becoming a leading player in the oncology segment. Other big pharma names involved in the business of cancer drugs include Cipla, Lupin, Alkem Labs, Biocon, Sanofi India, Glenmark, Mylan India, Intas Pharmaceuticals, to name a few.

Other companies envisioning future growth potential in the oncology business include Aurobindo Pharma and Alembic Pharma. The Hyderabad-based firm Aurobindo Pharma is working on plans to launch cancer treatment and injectable products in the European Union. Drug firm Alembic Pharmaceuticals Ltd has recently entered into oncology segment by inaugurating Rs 300 crore anti-cancer drug facility at Halol in Gujarat.

Top Indian pharma companies dealing with oncology based products

|

1. Cipla

|

|

2. Lupin

|

|

3. Sun Pharma

|

|

4. Dr. Reddys

|

|

5. Alkem Labs

|

|

6. Biocon

|

|

7. Cadila Healthcare

|

|

8. Sanofi India

|

|

9. Glenmark Pharmaceuticals

|

|

10. Mylan India

|

|

11. Intas Pharmaceuticals

|

Latest developments in Indian oncology space -

Sun Pharmaceutical Industries Ltd.: Sun Pharma has acquired skin cancer drug Odomzo from Swiss drug giant Novartis for $175 million (around Rs 1,172 crore) as it looks to grow its specialty drug portfolio. The transaction gives Sun Pharma its first branded oncology product. Odomzo (molecule name Sonidegib) has been approved for sale in 30 countries including those in Europe, US, and Australia. “Odomzo gives us an opportunity to meaningfully expand our already established branded dermatology business and support our expansion into branded oncology with a launched brand,” said Kirti Ganorkar, global head of business development at Sun Pharma.

Last year Sun Pharma announced the roll-out of Gemcitabine InfuSMART, used in the treatment of cancer, in Europe. More InfuSMART oncology products are currently in Sun Pharma’s pipeline, to be rolled out in future. Over the next few months, Sun Pharma will launch Gemcitabine InfuSMART across the Netherlands, the UK, Spain, Germany, Italy and France.

Cipla: Cipla Europe NV, a 100 per cent subsidiary of Cipla Limited, has presence in several countries in Europe through its partners and own network. Cipla is focused on offering a new pharma concept built on layers of value such as newer products, concepts, formats, information and services to help healthcare providers across Europe.

Cipla offers range of products in Europe —Respiratory, HIV, Vaccines, OTC, API, Plain Generics and Hospital products. Cipla is focused on adding innovative elements, products and services by building direct-to-market presence in several countries.

Dr Reddy’s Laboratories Ltd.: Dr. Reddy’s has recently announced expansion of its commercial operations in Europe with the introduction of its portfolio of generics in France. The first products will be made available in the hospital market in the area of oncology and anti-infectives, including antimycotics.

The company recently launched selected products of its hospital portfolio in Italy and Spain, and is looking to further strengthen its presence in the two countries with the launch of anti-HIV products this year.

Abhijit Mukherjee, Chief Operating Officer, Dr. Reddy’s Laboratories said, “It is our constant endeavor to enhance the reach of our affordable and difficult-to-produce drugs. Our business expansion in Europe is a testimony to Dr. Reddy’s commitment to ensure access to affordable medicine for patients across the globe.” With a diversified portfolio of injectables and complex generics, Dr. Reddy’s currently has two R&D centres, one manufacturing, and a packaging and storage facility in Europe.

Zydus Cadila: After having established a strong presence in cardiology, respiratory and other segments, pharma major Cadila Healthcare, popularly known as Zydus Cadila, is betting big on oncology and aims to become the number one in the segment by 2020.

Considering the high occurrences of cancer in the country, Zydus has been building a product pipeline to realize its vision of becoming a leading player in the oncology segment. “Looking at what is happening in India, we intend to build a large oncology platform. We have a strong product pipeline and we have been developing products for US and Europe with the largest and newest generation portfolio so far. The next new market for therapy will be oncology for us," said Sharvil Patel, joint managing director of Cadila Healthcare.

Biocon Ltd.: Bio-pharmaceutical company Biocon Ltd. expects to see its first set of biosimilar products hit the European market by early 2018.

The company, in partnership with Mylan NV, is developing four biosimilars—pegfilgrastim, trastuzumab, adalimumab and insulin glargine—for regulated markets such as Europe and US. Two of Biocon’s biosimilars—trastuzumab and pegfilgrastim—are under review by European drug regulator the European Medicines Agency (EMA). The EMA’s website shows the agency is assessing 2 rituximab biosimilars and 3 trastuzumab biosimilars. The Mylan/Biocon breast cancer biosimilar drug (trastuzumab) may be first of the 3 to be approved later this year in Europe.

New entrants in the Indian oncology market

Aurobindo Pharma Ltd.: Aurobindo Pharma is devising a plan to expand into EU countries such as Poland and the Czech Republic as part of its broader efforts to consolidate business over the next 3-4 years. The Hyderabad-based firm is working on plans to launch cancer treatment and injectable products in the European Union.

The acquisition of Generis Farmaceutica SA has already catapulted the company into a big league in the Portuguese generic market in terms of value and volume. It has also completed the acquisition of Orocal brand to leverage its position as a key player in the French drug market.

Alembic Pharmaceuticals Ltd.: Drug firm Alembic Pharma has recently entered into oncology segment by inaugurating a Rs 300 crore anti-cancer drug facility at Halol in Gujarat. With this facility, the Alembic Pharma will commence exporting oncology products to US, Middle East, North Africa, Australia and South Africa. Alembic has recently invested in an ultra-modern R&D centre at Hyderabad. It is one of the leading players in the industry to have invested about 11 per cent of its turnover in R&D.

Lately, Indian drug companies are facing strong headwinds due to prompt regulatory action of United States Food and Drug Administration (USFDA), likely imposition of Border Adjustment Tax (BAT) and delay in new drug approvals.

Probably, it is the best time for Indian pharma companies to explore opportunities and business in the European market.

|

Reasons for shortage of cancer drugs in Europe:

(1) Quality: manufacturing issues – 37 per cent

(2) Quality: delays/capacity – 27 per cent

(3) Raw materials – 27 per cent

(4) Increased demand – 5 per cent

(5) Discontinuation – 2 per cent

(6) Loss of manufacturing site – 2 per cent

|

Source: 2016 FDA report

India's Pharma exports to European countries during 2015-16 in $ mn

|

Country

|

FY 2015

|

FY 2016

|

|

UK

|

543.24

|

564.29

|

|

Germany

|

372.67

|

347.53

|

|

Netherland

|

243.48

|

243.49

|

|

France

|

209.00

|

232.16

|

|

Belgium

|

154.01

|

192.15

|

Source: Pharmexcil annual Report 2015-2016

Indian pharma companies having European Accreditations

|

S NO

|

Regulatory Agency

|

No.s

|

|

1

|

Formulation companies with USFDA approvals.

|

53

|

|

2

|

Number of Certificate of Suitability (CEPs) received (as of February 2016)

|

1354

|

|

3

|

Number of companies with CEPs

|

220

|

|

4

|

Number of Molecules for which CEPs have been filed with European Directorate for the Quality of Medicines (EDQM)

|

382

|

|

5

|

No of Sites with EU GMP Compliance (Good Manufacturing Practice) as on 15thFebruary 2016

|

631

|

|

6

|

UK MHRA (Medicines Healthcare Regulatory Agency), Market authorizations as on March 2015

|

1559

|

|

7

|

Number of CEPs with Irish Medicines Board

|

300

|

|

8

|

Number of companies registered in Irish Medicines Board

|

19

|

|

9

|

Number of Authorisations with Sweden MPA or Medical Products Agency (Läkemedelsverket)

|

209

|

|

10

|

Number of companies having MA`s with Sweden MPA (Läkemedelsverket)

|

14

|

Source: Pharmexcil annual Report 2015-2016

Six policy recommendations highlighted by Economist Intelligence Unit (EIU) to address cancer medicines shortages in Europe

- Introduce legislation for early notification requirements for medicines shortages -

National legislation for early notification from manufacturers should be implemented in all European countries. Moreover, greater harmonisation of national legislation including a common definition and trigger points across EU Member States will ensure better compliance from manufacturers and will facilitate developing strategies for managing shortages and preventing future shortages.

- Establish strategic plans for medicines shortages -

The existence of a national strategic plan for medicines shortages will allow for a coordinated response at a national level with a clear allocation of responsibilities for specific actions. This will ensure that the issue is addressed in a coordinated manner, with the collaboration of all stakeholders, including national competent authorities, industry, distributors, pharmacists, clinicians and other healthcare providers, as well as patients and patient organisations.

- Develop catalogues of shortages -

It is essential to have comprehensive, reliable data about medicines shortages in every member country of the EU/EEA. A catalogue or database of shortages that is easily accessible for all stakeholders, including patients, can provide the missing data and ensure visibility of the problem. Awareness about medicines shortages will facilitate collaboration among stakeholders to resolve the issue.

- Develop essential medicines lists and assess the risk for shortages -

A risk assessment approach should be used to understand the underlying causes for medicines shortages on this list and flag high-risk situations, for example identify products with a single manufacturer, and implement measures to address potential shortages. This could require a coordinated international action such as developing a European catalogue of shortages.

- Introduce incentives for production infrastructure improvements -

As part of the long-term prevention strategies that aim to address the underlying causes of supply disruptions, the FDA strategic plan has highlighted the need to develop methods to incentivise and prioritise manufacturing quality. The plan suggests that payers should explore economic incentives to encourage high quality manufacturing that could help reduce the occurrence of shortages.

- Establish procurement models designed to prevent medicines shortages -

Certain procurement practices for generic medicines could result in medicines shortages. The choice of procurement method and type of award should be based on a comprehensive analysis of the market conditions, for example, the number of suppliers in the market, the market capacity, demand for the product, its cost, plans for future use, etc. When risks to supply security are identified in this analysis, the tender criteria and agreements should be adjusted to mitigate this risk. For example, extended contract periods could be used, or agreements that ensure supply guarantee.

Top Hospitals and Medical Centers associated with Cancer Research in Europe:

|

Neolife Oncology Center, Istanbul, Turkey

|

Acibadem Healthcare Group, Istanbul,

Turkey

|

|

Villa Donatello, Florence, Italy

|

EmCell Clinic | Stem Cell Treatment,

Kiev, Ukraine

|

|

International Clinic, Frankfurt, Germany

|

Kolan Hospital Group, Istanbul, Turkey

|

|

Istituto Europeo di Oncologia IEO, Milan, Italy

|

Sanomni Health, Bad Worishofen,

Germany

|

|

Kent Hospital, Izmir, Turkey

|

Kliniken Allianz Munchen

|

|

Sarafianos Hospital, Thessaloniki, Greece

|

Placid Greece, Athens, Greece

|

|

Marinus am Stein Holistic Cancer Therapy Clinic

|

Neolife Medical Center Romania

|

|

Medicana Health Group, Istanbul, Turkey

|

Anova Medical Center | CCSVI Center

|

Source: https://cancerconvention.wordpress.com

Top Universities related to cancer research in Europe:

|

European Cancer Stem Cell Research Institute

|

European University for Cancer Research

|

|

European Society for Medical Oncology

|

The Netherlands Cancer Institute

|

|

The Organisation of European Cancer Institutes

|

Cancer Research Institute

|

|

German Cancer Research Center

|

Heidelberg University Hospital

|

|

University Cancer Center

|

European Institute of Oncology

|

|

Padua University

|

UZH – Institute of Molecular Cancer Research

|

Source: https://cancerconvention.wordpress.com

Cancer related Societies and Associations in Europe:

|

European Organisation for Research and Treatment of Cancer

|

European Cancer Organisation

|

|

European Society of Gynaecological Oncology

|

European Institute of Oncology

|

|

EuroPharm Forum

|

European Society for Medical Oncology

|

|

Organization of European Cancer Institutes

|

European and American Osteosarcoma

Study Group

|

|

Association of European Cancer Leagues

|

European Organisation for Research and

Treatment of Cancer

|

Source: https://cancerconvention.wordpress.com